The CEO Shareholder: Straightforward Rewards for Long-term Performance

Harvard Corporate Governance

OCTOBER 23, 2023

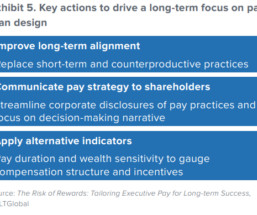

EXECUTIVE SUMMARY To be successful, companies need to attract and reward leaders who create value over the long term, but executive remuneration often focuses on short- term targets. Shareholders and their advisors similarly focus on short-term returns as a primary metric in the evaluation of pay plans. more…)

Let's personalize your content