Understanding the Company-Specific Risk Premium: A Guide for Attorneys

Gross Mendelsohn

SEPTEMBER 13, 2022

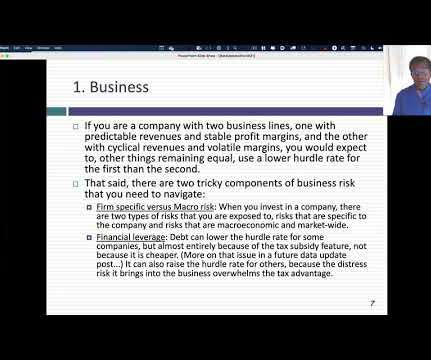

Understanding risk factors is essential in determining how a business will be valued. Let’s consider what your business-owning clients need to know about company-specific risks and how they come into play when it’s time for a business valuation.

Let's personalize your content