Board effectiveness: A survey of the C-suite

Harvard Corporate Governance

JUNE 4, 2024

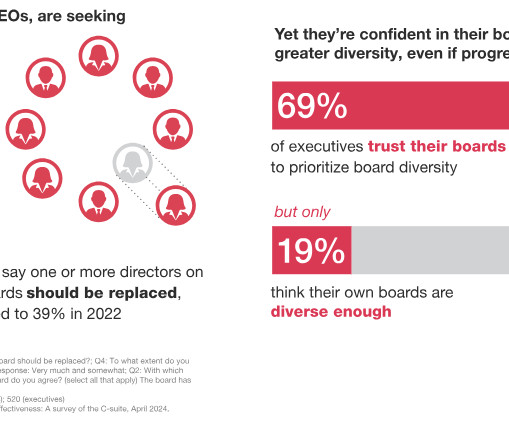

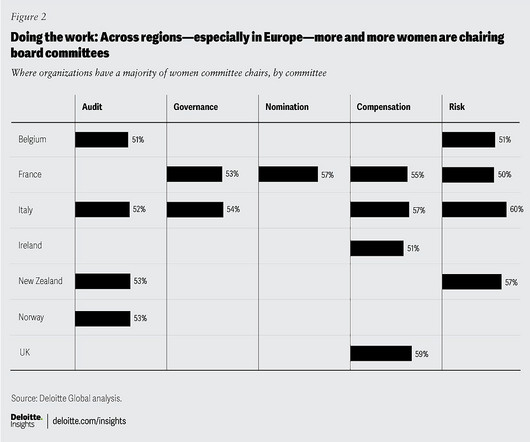

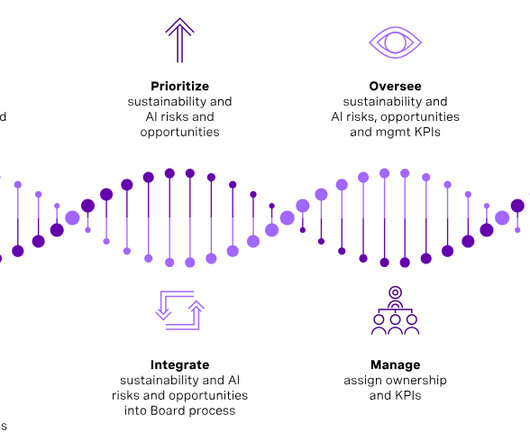

Posted by Carin Robinson, PricewaterhouseCoopers LLP, on Tuesday, June 4, 2024 Editor's Note: Carin Robinson is Director at the PricewaterhouseCoopers (PwC) Governance Insights Center. This post is based on her PwC memorandum. Against a backdrop of increasing fragmentation and complexity, companies are seeking to develop and execute coherent strategies, and corporate governance needs to keep pace, with directors addressing more topics and fielding input from more stakeholders.

Let's personalize your content