The Credit Markets Go Dark

Harvard Corporate Governance

AUGUST 8, 2024

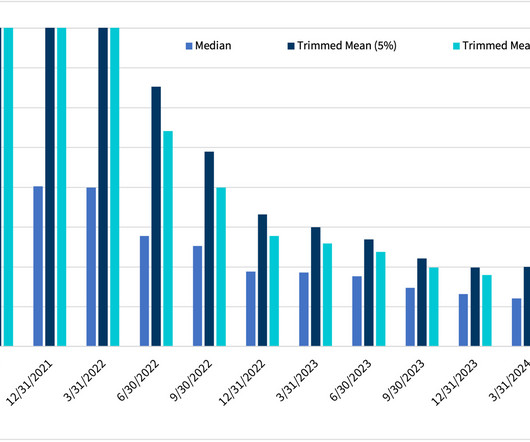

In The Credit Markets Go Dark , we describe how private credit funds are reshaping corporate governance and corporate finance and offer new data capturing its meteoric rise. trillion in 2023. more…)

Let's personalize your content