Total Shareholder Return: What Is It And Why Does It Matter?

Quantive

MARCH 1, 2022

Business owners raise funds by inviting venture capital and private equity investments. […]

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Total Shareholder Return Related Topics

Total Shareholder Return Related Topics

Quantive

MARCH 1, 2022

Business owners raise funds by inviting venture capital and private equity investments. […]

Harvard Corporate Governance

OCTOBER 23, 2023

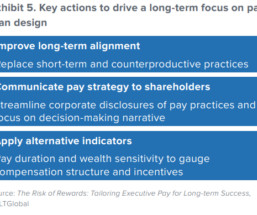

Yet say-on-pay voting at publicly listed companies has arguably had the opposite of its intended effect, driving up executive compensation and showing little relationship to long-term shareholder interests. Total shareholder return is the most common metric that shareholders employ to align interests, but it is often short term-oriented.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Harvard Corporate Governance

MAY 16, 2023

The 2023 Say on Pay (SOP) season has a unique hallmark unlike previous SOP years: most companies within the S&P 500 have experienced significant decreases in total shareholder return (TSR) in the most recent performance year (2022) for the first time since SOP was mandated in 2011.

Harvard Corporate Governance

AUGUST 1, 2023

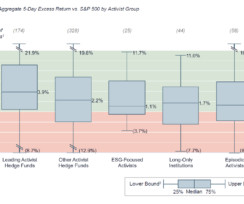

We measured total shareholder return (TSR) versus the S&P 500 over one week and one year as proxies for short term and long-term excess return generation. Our empirical review included campaigns waged between 2018 and H1 2023 at U.S.

Harvard Corporate Governance

JANUARY 18, 2024

We also discuss other guidance and updates for the 2024 proxy season including requirements relating to compensation clawbacks, reminders relating to advance notice bylaws and officer exculpation amendments, a roundup of shareholder proposal trends for the 2023 proxy season, and updated proxy advisor guidance for the 2024 proxy season.

Harvard Corporate Governance

JUNE 7, 2023

Separately, companies are also required to disclose their total shareholder return (TSR) and the TSR of their peer group. more…)

Harvard Corporate Governance

JANUARY 27, 2023

This table will include, for the principal executive officer (PEO) and, as an average, for the company’s other named executive officers (NEOs), the summary compensation table measure of total compensation and a measure of “executive compensation actually paid,” as specified by the rule.

Harvard Corporate Governance

MAY 24, 2022

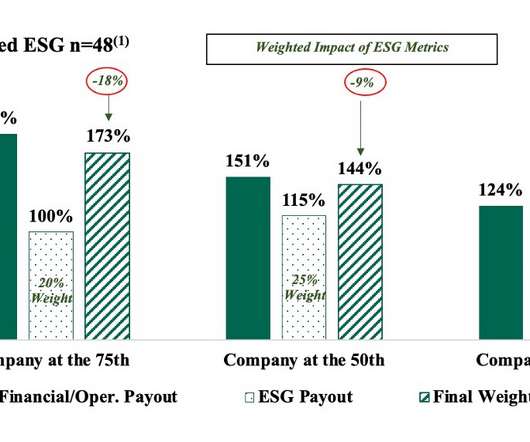

This unprecedented movement in incentive metric usage—much faster even than the relative total shareholder return (TSR) transition—is caused by many factors: from boards’/executives’ desire to help improve the social footprint of their companies and society to responding to shareholder pressures.

Harvard Corporate Governance

MAY 19, 2022

Bebchuk and Roberto Tallarita (discussed on the Forum here ); Companies Should Maximize Shareholder Welfare Not Market Value by Oliver Hart and Luigi Zingales (discussed on the Forum here ); Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee by Max M. Schanzenbach and Robert H.

Harvard Corporate Governance

DECEMBER 14, 2022

The new requirements consist of three components: (i) a pay-versus-performance table that includes metrics from the previous five fiscal years such as CEO and NEO compensation “actually paid,” cumulative total shareholder return (TSR) for the company and its peer groups, financial performance measures and the company’s net income; (ii) a description (..)

Harvard Corporate Governance

OCTOBER 3, 2023

Say on Pay (SOP) votes were mandated by the Dodd-Frank Act of 2010 as a mechanism to allow shareholders to voice their opinions about the level and structure of executive compensation as well as promote the engagement of companies and their shareholders regarding a key area of corporate governance.

Harvard Corporate Governance

APRIL 3, 2023

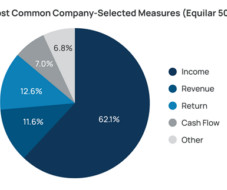

Comparator Group for Total Shareholder Return (TSR) Calculations The majority of companies in our sample elected to use an industry index rather than a custom benchmarking peer group, most often the same industry index that companies use for the Stock Performance Graph in the 10-K. and also made observations on unique findings.

Harvard Corporate Governance

APRIL 27, 2023

Vanbastelaer, Kyle McCarthy, Nathan Grantz, and Anish Tamhaney. 2022 PEO Multiples by Sector In 2022, Energy CAP to SCT rations are the highest thus far, while Consumer Discretionary sector ratios are the lowest on average TSR vs.

Harvard Corporate Governance

JULY 31, 2022

Their company evaluations now consider a broader set of financial metrics beyond total shareholder return, and their stewardship priorities now focus heavily on environmental, social, and governance (ESG) topics. Institutional investors and proxy advisors are signaling increased expectations through policy expansion.

Harvard Corporate Governance

MAY 9, 2022

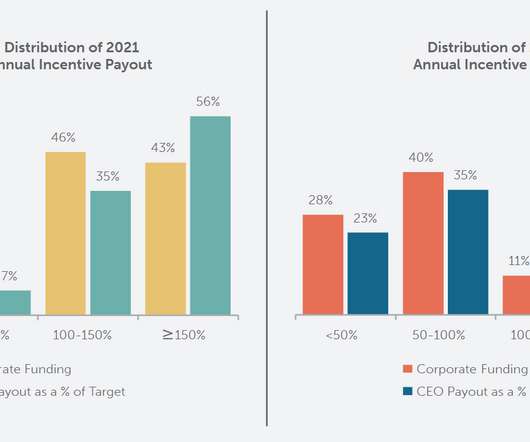

Revenue (+17.1%), pre-tax income (+62.5%), EPS (+71.0%), and one-year total shareholder return, or TSR, (+35.8%) were all up substantially. Performance: 2021 median performance—as measured by revenue, pre-tax income, and earnings per share (EPS)—was higher than 2020. CEO Pay: Median CEO pay increased by +19%.

Harvard Corporate Governance

OCTOBER 6, 2022

a new measure: Compensation actually paid) and certain financial performance measures (company total shareholder return or TSR peer TSR, net income and a financial metric of the company’s choosing), covering five years of data.

Harvard Corporate Governance

SEPTEMBER 19, 2022

a table (the Tabular List ) of the most important performance measures used by the company to link compensation actually paid to the executives to company performance.

Benzinga

FEBRUARY 29, 2024

29, 2024 (GLOBE NEWSWIRE) -- First Advantage Corporation (NASDAQ: FA ), a leading provider of employment background screening, identity, and verification solutions, announced today that it has entered into a definitive purchase agreement to acquire Sterling Check Corp.

Reynolds Holding

DECEMBER 10, 2023

Part of the board’s responsibility is to ensure capital allocation decisions are made with a rationale founded in creating good long-term total shareholder returns. The board needs to manage the conflicts between the agents, the principals and indeed between the longer and shorter-term shareholders within the principals.

M&A Leadership Council

AUGUST 1, 2023

Large public companies are generally expected to link their CEO pay to total shareholder return over one to three years, whereas a new start-up will tend to focus more on sales growth. Bonus pay may be hard to align following a merger between one firm with huge bonuses and another one with none.

Reynolds Holding

AUGUST 25, 2022

These key performance metrics include total shareholder return (TSR), peer group TSR, net income, and a measure specific to the company. Companies will disclose several key performance metrics related to executive compensation.

Harvard Corporate Governance

NOVEMBER 9, 2022

In addition to the columns for executive compensation outlined above, the new table will include the following metrics for company performance: The company’s total shareholder return (TSR), The TSR of the company’s self-selected peer group, The company’s net income, and. Measuring the Performance Element.

Benzinga

APRIL 12, 2023

For our long-term shareholders, this transaction crystalizes a total shareholder return of approximately 700% since the 2016 merger of Triton and TAL International. "The sale price provides significant value to our investors and represents a 35% premium to yesterday's closing share price.

Reynolds Holding

FEBRUARY 4, 2024

The NYSE and Nasdaq adopted listing standards last year to implement the SEC’s clawback rule – these standards became effective on October 2, 2023, and listed companies had until December 1, 2023 to adopt a compliant clawback policy.

Harvard Corporate Governance

FEBRUARY 17, 2024

Executive Summary In 2022, median CEO actual total direct compensation (TDC)* among S&P 500 companies was flat, in line with a substantial decrease (-18%) in total shareholder return (TSR).

Reynolds Holding

MARCH 6, 2024

And the utility function must include criteria to weight tradeoffs between different sets of stakeholders.

Reynolds Holding

NOVEMBER 30, 2023

With respect to a registrant providing initial Pay versus Performance disclosure in its 2023 proxy statement for three years (as permitted by Instruction 1 to Item 402(v) of Regulation S-K), may the registrant present the peer group total shareholder return for each of the three years using the 2022 peer group? Answer: No.

Reynolds Holding

MARCH 1, 2023

Financial reporting measures also include stock price and total shareholder return (TSR). What if the incentive-based compensation is based on stock price or Total Shareholder Return (TSR)? Same as the NYSE. Same as the NYSE.

Value Scope

JULY 21, 2020

How do you justify making substantial investments and fundamental changes to corporate structures and culture without empirical evidence that it will make a direct impact on shareholder value, total shareholder return, net present value, and individual rates of return? What about stock price?

Harvard Corporate Governance

MARCH 7, 2023

Executive Summary In 2021, CEO median actual total direct compensation (TDC*) among S&P 500 companies increased +14% driven by higher actual bonuses. Similarly in 2021, the S&P 500 total shareholder return (TSR) increased +29%.

Harvard Corporate Governance

OCTOBER 9, 2023

The rule generally requires disclosure of five years of pay versus performance data.

Reynolds Holding

JUNE 14, 2022

Incentive-based compensation is any compensation that is granted, earned or vested based wholly or in part on the attainment of a financial reporting measure, including stock price or total shareholder return.

Benzinga

FEBRUARY 29, 2024

The transaction is expected to drive attractive total shareholder returns, including at least $50 million of synergies, implying expected double-digit Adjusted EPS accretion immediately on a run-rate synergy basis and accelerated earnings growth potential from topline development, synergies, and deleveraging.

Reynolds Holding

OCTOBER 27, 2022

Instead, the Commission is requiring companies to claw back compensation based on stock price and total shareholder return (“TSR”). We reasonably could have limited the definition to accounting-based metrics.

Cooley M&A

JANUARY 30, 2024

Monitoring performance relative to peers, including on a total shareholder return basis over one-, three- and five-year periods. Taking investor feedback into account, as well as taking credit in investor materials and communications when changes have been made in response to feedback.

Reynolds Holding

SEPTEMBER 6, 2022

footnote disclosure to the table for any amounts deducted and added to total compensation of the NEOs to determine the amount of compensation “actually paid” (as described below) and certain related assumptions, as well as the name of each CEO and other NEO included in table for each year and the fiscal year for which they were included.

Reynolds Holding

MARCH 5, 2023

Moreover, if PVP disclosure was required in a Form 10 (and its accompanying “information statement”), it would not be possible to complete column (f) of the PVP table with respect to the company’s total shareholder return (TSR), since the spin-off company would not have been publicly traded for any of the years covered by the PVP table.

Reynolds Holding

AUGUST 30, 2023

While traditional activism focused on short-term profit, stock price and total shareholder return (TSR) continues, a new set of activists has emerged, galvanized by climate and other environmental, employee/human capital, social and governance concerns.

Reynolds Holding

SEPTEMBER 7, 2022

Traditional activism, focused on short-term profit, stock price and total shareholder return (TSR), continues alongside a new form of activism emphasizing climate and other environmental, employee/human capital, social and governance (ESG) considerations.

Value Scope

SEPTEMBER 24, 2020

How do you justify making substantial investments and fundamental changes to corporate structures and culture without empirical evidence that it will make a direct impact on shareholder value, total shareholder return, net present value, and individual rates of return? . These are fair questions.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content