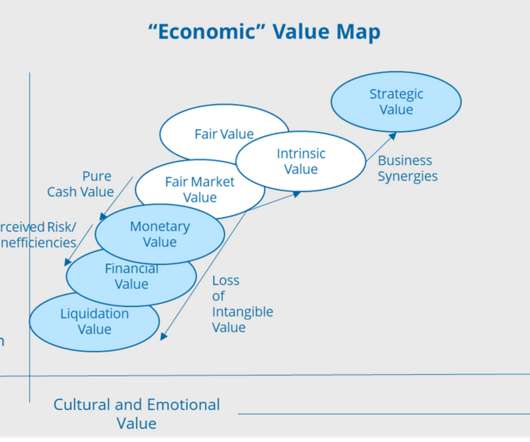

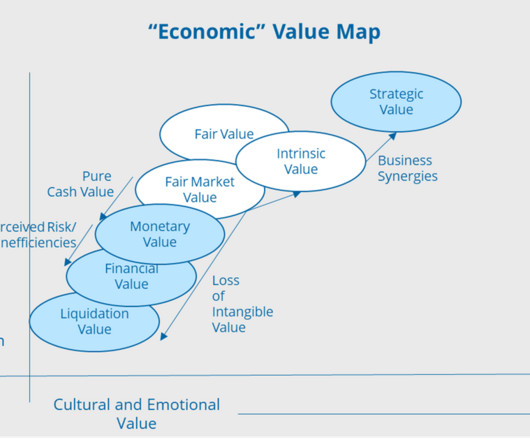

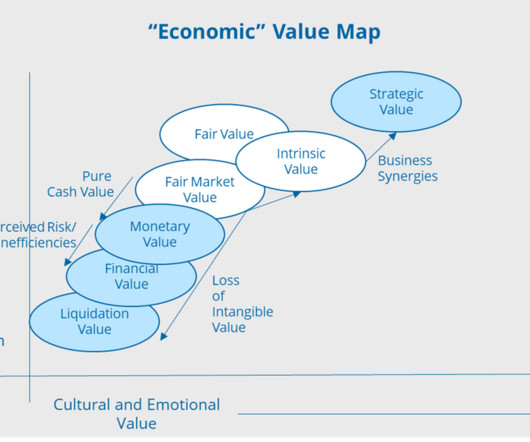

Value of Equipment: Liquidation, Replacement, or Fair Market?

Peak Business Valuation

MARCH 14, 2024

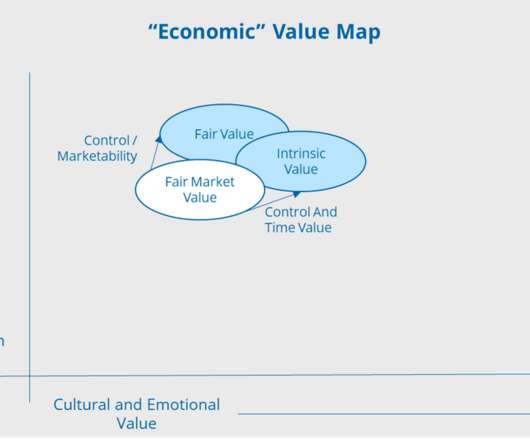

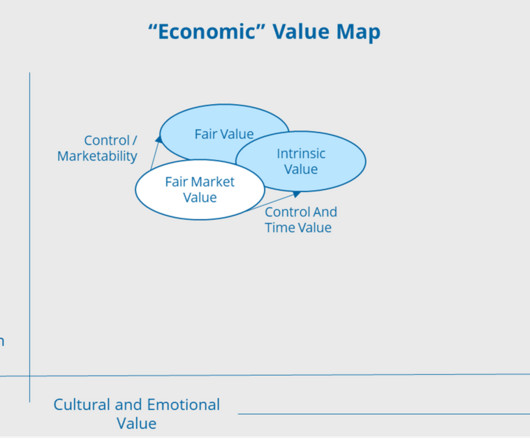

These include the liquidation value, replacement value, and fair market value. In this article, we explore the nuances of methods for valuing equipment. Each equipment valuation approach—liquidation, replacement, and fair market —has its strengths and limitations.

Let's personalize your content