Middle Market Private Equity M&A Activity – Q2 2020

Value Scope

SEPTEMBER 4, 2020

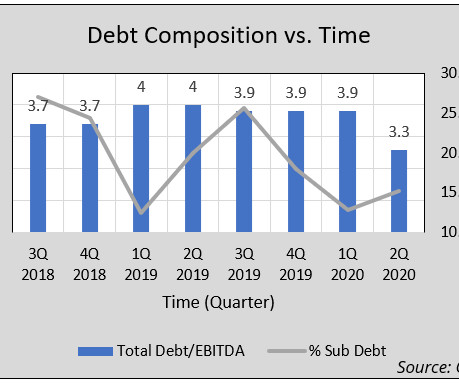

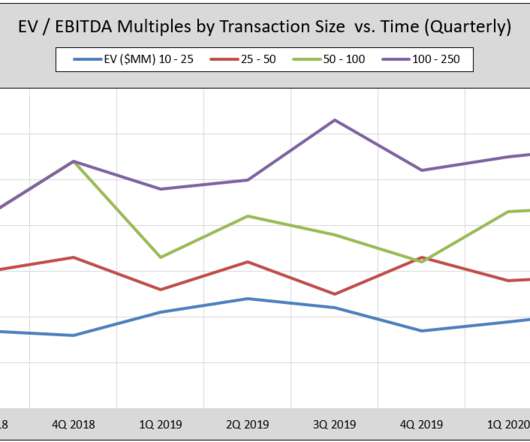

Click to Download: Middle Market Private Equity M&A Activity – Q2 2020 Executive Summary Transaction Volume Shrinks Only 31 transactions were reported in Q2 2020, bringing the total reported transactions in 2020 to 113. Size Premium Size became an even greater pricing consideration for the middle market as transaction multiple variances widened for acquisition targets above and below $50 million.

Let's personalize your content