Murder on the City Express – Who is Killing the London Stock Exchange’s Equity Market?

Harvard Corporate Governance

MAY 23, 2023

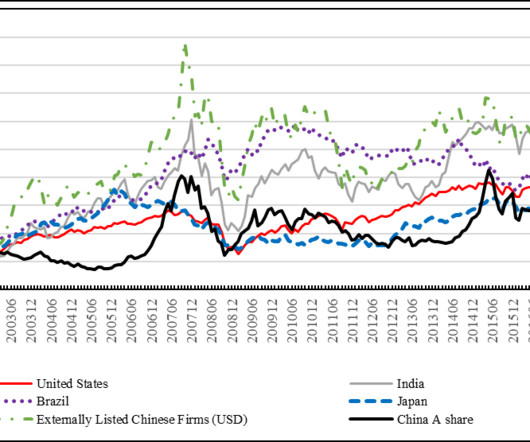

peers on at least one significant measure – the market capitalization to Gross Domestic Product (“GDP”) ratio. exchanges have seen a consistent rise in the aggregate market capitalization to GDP ratio since at least 2017, the equivalent metric for the U.K. As we underscored in a previous paper , while the U.S.

Let's personalize your content