Banking Crises in Historical Perspective

Harvard Corporate Governance

MAY 12, 2023

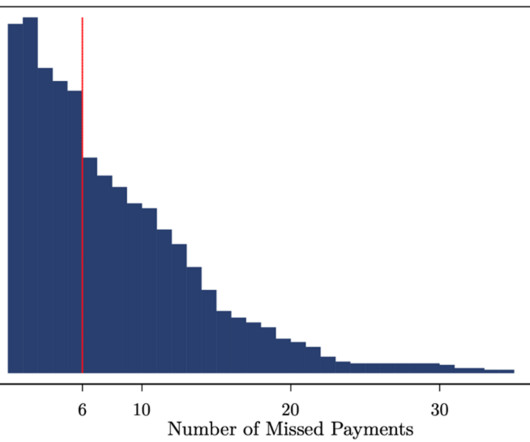

The survey paper is organized around three main lessons learned about banking crises: the importance of leverage as a precursor to crises, the large and negative real impact of crises on various sectors of the economy, and that government and central bank intervention has historically ameliorated these effects. more…)

Let's personalize your content