Vincenzo Pezone is an Associate Professor of Finance at Tilburg University. This post is based on a recent paper by Professor Pezone, Christian Mücke, Loriana Pelizzon, and Anjan V. Thakor.

Despite the well-publicized negative effect of bailouts on ex ante incentives, it is often practically infeasible for governments to avoid bailing out failing banks, especially if many banks fail together, i.e., in the presence of systemic risk. However, bailouts are costly, as they are also associated with both ex ante and ex post moral hazard. If banks anticipate receiving subsidized equity during a crisis, their ex ante incentives to be well capitalized may be weakened, and they will welcome government assistance during a crisis. Once capital is infused, bank managers may have an ex post incentive to avoid making dividend payments on the preferred stock purchased by the government.

![]() During the 2007-09 financial crisis, the US Treasury attempted to restore financial stability by developing the Capital Purchase Program (CPP), a recapitalization program under which it purchased preferred stock in troubled financial institutions in order to infuse capital in them. The design of this program appears to have been motivated by these concerns about ex ante and ex post moral hazard associated with government capital assistance. One key feature of the CPP was the linking of quarterly payments made on the Treasury preferred stock and subordinated debt to the voice the government had in the bank’s corporate governance. If the bank missed six quarterly dividend payments on the securities held by Treasury, Treasury had the option to appoint up to two (voting) directors on the bank’s board. Putting its own directors on the board allows the government to potentially exercise corporate governance influence to limit ex post moral hazard. Moreover, if banks dislike governance intrusions by the government, they will take steps to avoid it and increase their capitalization before they become distressed, which makes the adverse ex ante incentive effect a less serious concern. But whether the potential is realized to make this an effective mechanism depends on whether these are ceremonial appointments or involve directors capable of flexing their corporate governance muscles to affect decision-making and bank performance. In our paper, we empirically examine this question.

During the 2007-09 financial crisis, the US Treasury attempted to restore financial stability by developing the Capital Purchase Program (CPP), a recapitalization program under which it purchased preferred stock in troubled financial institutions in order to infuse capital in them. The design of this program appears to have been motivated by these concerns about ex ante and ex post moral hazard associated with government capital assistance. One key feature of the CPP was the linking of quarterly payments made on the Treasury preferred stock and subordinated debt to the voice the government had in the bank’s corporate governance. If the bank missed six quarterly dividend payments on the securities held by Treasury, Treasury had the option to appoint up to two (voting) directors on the bank’s board. Putting its own directors on the board allows the government to potentially exercise corporate governance influence to limit ex post moral hazard. Moreover, if banks dislike governance intrusions by the government, they will take steps to avoid it and increase their capitalization before they become distressed, which makes the adverse ex ante incentive effect a less serious concern. But whether the potential is realized to make this an effective mechanism depends on whether these are ceremonial appointments or involve directors capable of flexing their corporate governance muscles to affect decision-making and bank performance. In our paper, we empirically examine this question.

The CPP was by far the most extensive recapitalization program ever implemented in the U.S. A total of 707 banks received capital injections of around 205 billion dollars. In the process, the U.S. Treasury acquired either cumulative, non-cumulative preferred stock, or, for a minority of banks, subordinated debt. (In the latter case, the payments on the securities owned by Treasury were in fact interest on debt. For expositional convenience, we will slightly abuse terminology and refer to all payments as dividends, even though some were interest.)

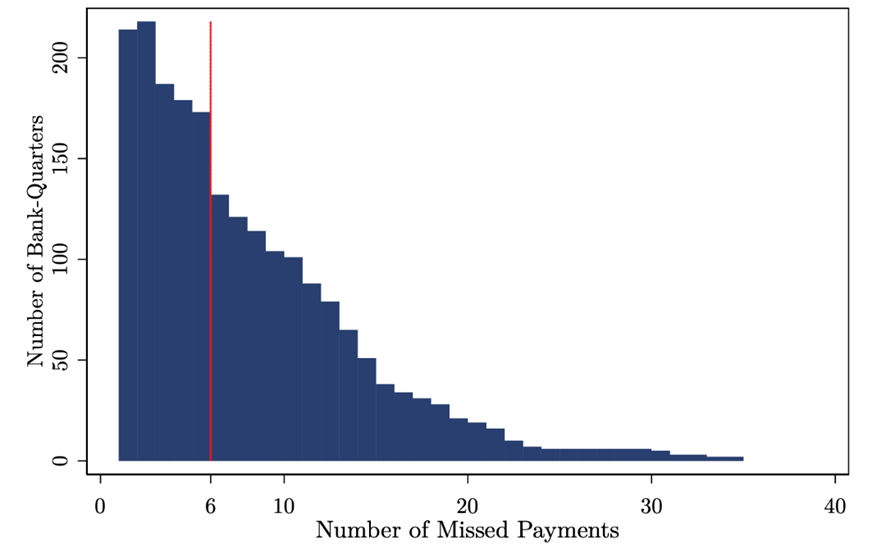

We find that banks strongly attempted to avoid triggering the appointment of government directors on their boards. We show that there is a clear discontinuity in the empirical distribution of missed dividend payments to the U.S. Treasury between five and six. While the number of bank-quarters with five missed dividend payments is 3.4% lower than the number of observations with four missed dividend payments, the empirical frequency drops by 24% when we move from bank-quarters with five missed payments to bank-quarters with six missed payments.

Distribution of Missed Dividend Payments

Note. This figure plots the distribution of missed dividend payments for 2,081 bank-quarter observations. Banks having 0 missed payments are excluded, leaving 195 banks that missed at least one dividend payment out of the 572 banks in the sample. The time coverage goes from May 2009 to October 2019.

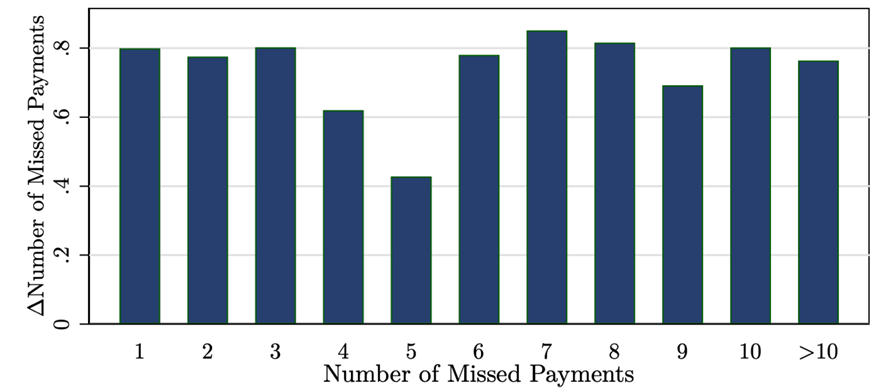

We then develop a simple theoretical model in which the bank manager (CEO) enjoys a private benefit of control and stands to lose it with government directors. The bank gets equity funding from the government and, as per the structure of the CPP, it must make dividend payments on it, with the stipulation that the government appoint directors on the board if a certain number of dividend payments are missed. It takes (privately observed) costly effort by the manager to generate the cash for the dividend payments to the government in any period. The model predicts that the manager will work harder to generate this cash as the bank gets closer to the threshold number of missed payments that triggers the appointment of government directors. Consequently, the probability of a missed dividend payment declines most precipitously right below the threshold for government director appointments, and is higher on either side of the threshold. Our evidence is consistent with the predictions of the model.

Conditional Distribution of Changes in Missed Dividend Payments

Note. This figure shows the average quarter-to-quarter change in the number of missed dividend payments for the 195 banks with 1, 2, …, 10, and more than 10 missed dividend payments at the end of the previous quarter. Observations for banks having 0 missed payments at the end of the previous quarter are excluded. The time coverage goes from May 2009 to October 2019.

We also analyze the 2013 Treasury announcement that it had abandoned a the policy of appointing directors on banks’ boards. We show that the banks that had missed less than six payments prior to the announcement, and thus had strong incentives to keep making payments, ended up decreasing their capital ratios after this announcement. Thus, the threat of director appointments induced banks to keep high capital ratios to enable them to continue making dividend payments to Treasury without risking undercapitalization through negative shocks.

We are a priori agnostic about why bank managers may dislike Treasury appointments. It may be because they believe that the appointees may be “bureaucrats” who will negatively impact board decision- making and diminish bank value. Alternatively, managers may be protecting their own interests, fearing that the new directors may reduce managerial entrenchment and rent-seeking.

To investigate this question, we examine changes in bank performance around actual director appointments. Of the 162 banks that, at any given point in time, became eligible for a director appointment, 16 received at least one Treasury-appointed director. We compare their performance with that of CPP banks that did not receive director appointments but are comparable in terms of several observable characteristics, such as size and capitalization. After government directors come on board, profitability improves, and the ratio of nonperforming loans to total loans declines. In addition, treated banks become less prone to engage in earnings management. We do not observe differences in the trends of these variables prior to the appointments. Moreover, there is some evidence of agency costs declining as well, since CEO compensation drops after the government directors join the board. Since we do not have exogenous variation in the probability of receiving a director appointment, we cannot make a definitive causal assertion, but the results strongly suggest that Treasury-appointed board members are unlikely to have destroyed value.

We then use a “case study” to further test the hypothesis that banks participating in the CPP did not want Treasury director appointments. In February 2009, Citigroup asked Treasury to convert a portion of its $20 billion of TARP preferred stock investment to common equity to strengthen its capital structure. In exchange, Citigroup agreed to alter the Board of Directors to have a majority of independent directors. Six directors, including a new chairman, were appointed, three of whom had previous experience in government or banking supervision. In October, 2012, the chairman forced Vikram Pandit, Citi’s CEO, to resign. This suggests that at least some of these directors were active in corporate governance, and that bank CEOs may be averse to such activism. We find that the number of banks in the program that were eligible for director appointments started dropping precisely after Pandit’s firing. We further show that the rate of exit from the CPP due to redemption of Treasury stock increased rapidly after this event. These findings are consistent with our hypothesis that Pandit’s firing made the consequences of unfriendly boards more salient to CEOs of banks funded by Treasury.

Taken together, these findings suggest the need for theories that provide conditions under which the kind of bailout mechanism used by the CPP is indeed the optimal mechanism to deal with the ex ante and ex post moral hazard created by the bailout. More generally, these theories could shed light on how the government, taking as a given the inevitability of bailouts during serious financial crises, could design these interventions to minimize their costs while coping with moral hazard.

Print

Print