Why strategists should embrace imperfection

Mckinsey and Company

APRIL 8, 2024

In a world of rapid change, looking for certainty can obscure opportunity. Taking smaller yet bold steps provides a more sure-footed path through uncertainty.

Mckinsey and Company

APRIL 8, 2024

In a world of rapid change, looking for certainty can obscure opportunity. Taking smaller yet bold steps provides a more sure-footed path through uncertainty.

Harvard Corporate Governance

APRIL 8, 2024

Posted by Gregory V. Gooding, Maeve O'Connor, and William D. Regner, Debevoise & Plimpton LLP, on Monday, April 8, 2024 Editor's Note: Gregory V. Gooding , Maeve O’Connor , and William D. Regner are Partners at Debevoise & Plimpton LLP. This post is based on a Debevoise memorandum by Mr. Gooding, Ms. O’Connor, Mr. Regner, Susan Reagan Gittes , and Jeffrey J.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

IVSC

APRIL 12, 2024

CAS-IVSC International Valuation Conference 2024 The China Appraisal Society (CAS) and the International Valuation Standards Council (IVSC) recently co-organised an international valuation conference, hosted by the Shanghai National Accounting Institute (SNAI) from 11 – 12 April 2024. Attendees included Mr. Yu Weiping, Vice Chairman of the Committee on Economic Affairs of the CPPCC National Committee, President of the CAS, and Mrs.

Benzinga

APRIL 11, 2024

Multi-state marijuana operator MariMed Inc. (CSE: MRMD ) (OTCQX: MRMD ) has closed the acquisition of Allgreens Dispensary, LLC on Tuesday, April 9, its fifth dispensary in Illinois. The Massachusetts-based company said the green light from the Illinois Department of Financial & Professional Regulation for the acquisition allows MariMed to fully consolidate the financial results of the company's Thrive-branded dispensary in Casey, Illinois.

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

Mckinsey and Company

APRIL 8, 2024

As the space economy expands, it could create value for multiple industries and solve many of the world’s most pressing challenges.

Harvard Corporate Governance

APRIL 8, 2024

Posted by Zachary J. Gubler (Arizona State University), on Monday, April 8, 2024 Editor's Note: Zachary J. Gubler is Marie Selig Professor of Law at the Arizona State University Sandra Day O’Connor College of Law. This post is based on his article forthcoming in the University of Chicago Law Review. There’s an old and venerable way of talking about corporate fiduciary duties that maintains that they are owed to the corporate entity itself.

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Benzinga

APRIL 8, 2024

A potential merger between media companies Skydance and Paramount Global (NASDAQ: PARA )(NASDAQ: PARAA ) has dominated headlines and could see further consolidation in the media sector. One shareholder of Paramount Global is calling out the merger efforts, which could provide cash to Shari Redstone and leave Paramount shareholders with a diluted value.

Mckinsey and Company

APRIL 12, 2024

Alex Hardiman, chief product officer of the New York Times, shares how a strong product-led strategy can elevate organizations across industries.

Harvard Corporate Governance

APRIL 11, 2024

Posted by Marco Ceccarelli (Vrije Universiteit), Stefano Ramelli (University of St. Gallen), and Alexander F. Wagner (University of Zurich), on Thursday, April 11, 2024 Editor's Note: Marco Ceccarelli is an Assistant Professor at Vrije Universiteit, Stefano Ramelli is an Assistant Professor at the University of St. Gallen, and Alexander F. Wagner is a Professor of Finance at the University of Zurich.

Financial Times M&A

APRIL 12, 2024

Deal by LetterOne comes after court victory for co-founders Mikhail Fridman and Petr Aven as they challenge EU sanctions

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Machen McChesney

APRIL 8, 2024

Worker productivity has been in the headlines recently. One reason is the easy access employers have to the many technologies that can monitor employees — from software that tracks when an employee swipes their badge at work to software that notes how long someone is at their computer and what they do while they are there. Another is a certain manifesting distrust of workers, particularly the increased numbers of remote workers.

Mckinsey and Company

APRIL 11, 2024

No risk, no reward. Banks can design an embedded-finance offering based on their size, distribution footprint, customer base, and product portfolio.

Harvard Corporate Governance

APRIL 10, 2024

Posted by Nathan Barnett, Ben Strauss, and Marina Leary, McDermott Will & Emery, on Wednesday, April 10, 2024 Editor's Note: Nathan Barnett and Ben Strauss are Partners and Marina Leary is an Associate a t McDermott Will & Emery. This post is based on their McDermott memorandum and is part of the Delaware law series ; links to other posts in the series are available here.

JPAbusiness

APRIL 9, 2024

A few years back, we were delighted to partner with business branding experts Richard Amos and Mike Wilkinson to create our ebook: Brand and Corporate Identity for Small to Mid-Sized Businesses. In this cheat sheet we have distilled some of Richard and Mike’s valuable tips for establishing and maintaining a successful brand identity. Click on the image to download a pdf version of the cheat sheet.

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

Machen McChesney

APRIL 8, 2024

Reporting on environmental, social, and governance (ESG) matters is an increasingly crucial area of corporate compliance. While ESG reporting and disclosure apply primarily to public companies, there are efforts aimed at requiring private companies to also report on these matters. For example, the European Union’s Corporate Sustainability Reporting Directive requires private organizations that meet specific criteria to publish social and environmental risks and their impacts.

Mckinsey and Company

APRIL 11, 2024

The CEO and cofounder of Drop discusses spinning off an adjacent business under a new brand during the COVID-19 pandemic while still scaling up the initial startup.

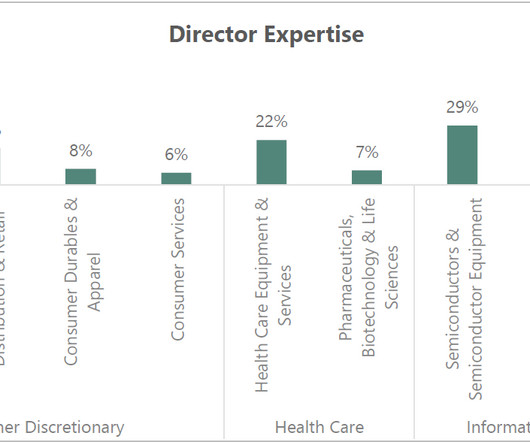

Harvard Corporate Governance

APRIL 11, 2024

Posted by Subodh Mishra, Institutional Shareholder Services Inc., on Thursday, April 11, 2024 Editor's Note: Subodh Mishra is Global Head of Communications at ISS STOXX. This post is based on an ISS-Corporate memorandum by Veronica Nikitas. Key Takeaways Only about 15% of companies in the S&P 500 provide some disclosure in proxy statements about board oversight of AI.

N Contracts

APRIL 9, 2024

Welcome to our April Regulatory Brief where the Ncontracts team of experts covers the most important regulatory compliance developments of March 2024.

Financial Times M&A

APRIL 11, 2024

Castlelake’s aircraft leasing focus fits private capital industry’s interest in asset-backed debts

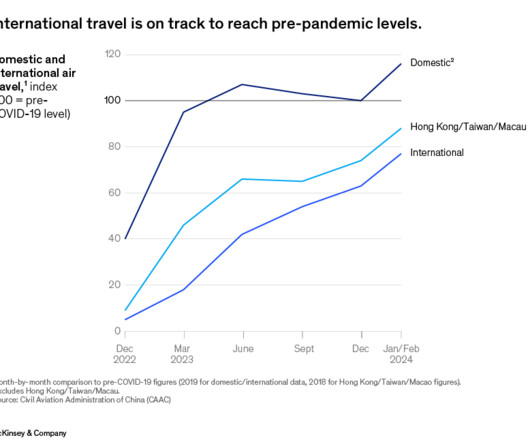

Mckinsey and Company

APRIL 7, 2024

Despite economic headwinds, Chinese consumption is exhibiting encouraging signs.

Harvard Corporate Governance

APRIL 11, 2024

Posted by Scott Shepard, Stefan Padfield, and Ethan Peck (The National Center for Public Policy Research), on Thursday, April 11, 2024 Editor's Note: Scott Shepard is General Counsel and Director, Stefan Padfield is Deputy Director, and Ethan Peck is an Associate of the Free Enterprise Project (FEP) at The National Center of Public Policy Research (NCPPR).

BV Specialists

APRIL 8, 2024

There are many reasons why a business owner should engage in an independent third-party appraisal of their company. They may be looking to sell, refinance, restructure, buy out a partner, or bring in new investors. But what about the importance of simply understanding realistically what your company is worth today by hiring a certified, experienced, unbiased professional to provide you with a complete analysis that you can rely on?

Financial Times M&A

APRIL 9, 2024

Private equity group sells stake for €1.

Mckinsey and Company

APRIL 10, 2024

Christopher Ailman, chief investment officer of the California State Teachers’ Retirement Fund, explains how performance can be enhanced by culture, diversification, and limiting CIO turnover.

Harvard Corporate Governance

APRIL 9, 2024

Posted by Ross Levine (Stanford University), on Tuesday, April 9, 2024 Editor's Note: Ross Levine is a Senior Fellow at the Hoover Institution at Stanford University. This post is based on a NBER working paper by Seungho Choi , Professor Levine, Raphael Jonghyeon Park , and Simon Xu. Foundational theories of the firm suggest that (1) shocks to expected cash flows influence shareholder preferences toward corporate risk-taking, and (2) shareholders may respond by altering the risk-taking incentive

BVR

APRIL 10, 2024

Tax planning is an essential aspect of financial management for businesses and individuals. However, with a complex and ever-changing tax landscape, it can be challenging to navigate these waters effectively, which is where RCReports can be a game-changer.

NYT M&A

APRIL 8, 2024

The low-cost airline, which has been unprofitable for four years, is trying to reduce costs after a federal judge blocked a proposed deal for JetBlue to acquire Spirit.

Mckinsey and Company

APRIL 8, 2024

For everyone from repair copilots to clerical assistants, generative AI can improve productivity and ease labor shortages. How can airlines and related companies get the basics right?

Harvard Corporate Governance

APRIL 9, 2024

The Harvard Law School Forum on Corporate Governance published a total of 647 posts during 2023, and its readership has continued to display steady growth, including: Attracting more than 200,000 unique readers a month; Having visitors to the Forum coming from 233 countries and territories during the year; and Attracting more than 4.1 million page views.

Appraisers Blog

APRIL 12, 2024

White House officials are engaging in the censorship campaign as part of a federal valuation task force known as PAVE.

Benzinga

APRIL 12, 2024

Cannabis industry's leading hiring platform Vangst has acquired CannabizTemp, the temporary staffing division of CannabizTeam. What Happened The company said on Friday the acquisition was 50% cash and 50% stock and is the first acquisition in the cannabis human resources (HR) space. The integration of CannabizTemp customers into Vangst will commence immediately.

Mckinsey and Company

APRIL 12, 2024

To help insulate themselves from economic headwinds, luxury brands have focused much of their attention on serving high-net-worth consumers. But aspirational luxury consumers are just as important.

Harvard Corporate Governance

APRIL 10, 2024

Posted by Mariana Pargendler (Fundação Getulio Vargas Law School), on Wednesday, April 10, 2024 Editor's Note: Mariana Pargendler is Full Professor of Law at Fundação Getulio Vargas Law School in São Paulo. She will join Harvard Law School as Professor of Law in July 2024. This post is based on her SSRN working paper. How does the Global South relate to the global debates on corporate governance?

Appraisers Blog

APRIL 12, 2024

How many of you would be surprised to know: “It’s funny, because FNMA’s collateral underwriter tool has a line item adjustment it makes on every comparable called the “CBG” adjustment. CBG stands for Census Block Grid. It’s essentially a location adjustment based on the median values of homes in that CBG. In my opinion, this adjustment the FNMA model makes is pretty much, in my personal opinion, is the equivalent of red lining.

Let's personalize your content