The Unicorn Puzzle

Harvard Corporate Governance

NOVEMBER 28, 2022

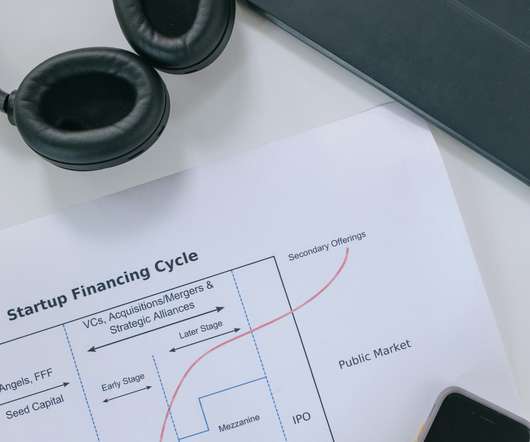

Unicorns are private companies with pro forma valuations of at least $1 billion. Unicorn status enables startups to access new sources of capital. Stulz , Daria Davydova , and Leandro Sanz. With this capital, they can invest more in organizational intangible assets with less expropriation risk than if they were public.

Let's personalize your content