Intel Receives Canadian Pension Money

Global Finance

AUGUST 31, 2022

Intel will retain majority ownership of new chipmaking factories in Arizona but will split the revenue with Brookfield Asset Management.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

money pensions

money pensions

Global Finance

AUGUST 31, 2022

Intel will retain majority ownership of new chipmaking factories in Arizona but will split the revenue with Brookfield Asset Management.

Harvard Corporate Governance

DECEMBER 8, 2022

Who are these “Maple Revolutionaries”, why did they warrant a feature article in THE ECONOMIST ten years ago, what lessons are there in this story for American public sector pension plans, and what does the great management philosopher Peter Drucker have to do with all this? This article addresses all four of these questions. trillion today.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Harvard Corporate Governance

MARCH 11, 2023

Individually and collectively, the developments are further fracturing an already complicated landscape for financial services companies, including private investment managers that invest money on behalf of state pensions. 2] In at least one state, banks are fighting back. [3] 3] (more…)

Reynolds Holding

APRIL 27, 2023

2] Yet even as the debate continues, public pension funds have invested roughly $3 trillion based on ESG principles. [3] There are two serious potential ramifications from applying the compelled speech doctrine to public pension funds. ESG Investing and Public Pensions: An Update , Ctr. 3] Jean-Pierre Aubry et al., for Ret.

Harvard Corporate Governance

OCTOBER 31, 2022

Registered investment advisers—over 15,000 of them in total—play a critical role in our economy, advising over 60 million accounts with combined assets under management of more than $100 trillion [1] These advisers provide advice to pension funds, endowments, retail investors, and so many others across the American public and beyond.

Benchmark Report

MAY 31, 2022

Dry powder, the amount of money private equity has at its disposal to make future investments, has gone up and up over the last ten years.

Equidam

JULY 14, 2022

On the buy-side, the companies that invest in VC funds generally have their shares traded on an exchange or are a pension or mutual fund, which see the value of their holdings diminish significantly due to lower share prices. The first money that disappears as stock prices fall is that of corporate venture capital. The buy-side.

Shuster & Co.

FEBRUARY 13, 2024

Your Social Security benefit might be reduced if you also get a pension from a job where you didn’t pay Social Security taxes (e.g., a civil service or teacher’s pension). If you made more money than your spouse (or ex-spouse), then they might be due a survivor’s benefit rate on your record if you die before they do.

Viking Mergers

FEBRUARY 20, 2023

To encourage small businesses to provide retirement options, the IRS offers a Retirement Plan Tax Credit — known as the Credit for Small Employer Pension Plan Startup Costs — that can help business owners recoup some of the startup expenses. Disabled Access Tax Credits Percentage: 50% of qualified costs up to $10,250.

Reynolds Holding

NOVEMBER 28, 2022

Crypto trading is wholly unconnected to the productive purpose that defines finance: helping businesses, individuals, and governments raise, save, transmit, and use money for socially and economically useful ends. The answer is simple. Crypto trading also shares a “closed loop” structure with gambling.

Brian DeChesare

JANUARY 19, 2022

Financial Sponsors Group Definition: In investment banking, the Financial Sponsors Group (FSG) advises private equity firms, hedge funds, sovereign wealth funds, and pension funds on capital issuances and transactions involving their portfolio companies. normal, non-wealthy individuals). There are many other differences as well.

Reynolds Holding

MARCH 6, 2024

Fearing that the emphasis on non-shareholders will harm the pension funds investing the hard-earned money of public employees, some states have enacted laws restricting the use of factors other than shareholder return in deciding how to invest state-level retirement assets. headquarters). billion from companies with U.S. headquarters).

Reynolds Holding

MAY 4, 2023

15] Shareholders who were attentive to the company’s human rights risk, and as a result avoided Tahoe stock before the license suspension, saved a significant amount of money. 13] “Fiduciary Duties of Public Pension Systems and Registered Investment Advisors,” posted by Matt Cole, March 1, 2023. 3°C by 2100. [25] Available here. [14]

Brian DeChesare

NOVEMBER 16, 2022

Mainstream news sources have already covered the story extensively, so I want to take a different angle and comment on how “the smart money” fell for this scam and what it could mean for careers in finance. Based on these numbers, it seems highly unlikely that FTX customers will recover much of their money.

Equidam

JULY 18, 2022

Revenue projections which compare well to peers may look completely erroneous to someone more experienced with ‘brick and mortar’ business, or watching their pension fund go up. If so, calculate your valuation from there, if they are offering $20k for 8%, that is an implied post-money valuation of $20k/8% = $250k, and so a pre-money of $230k.

Reynolds Holding

JUNE 15, 2022

But unless some significant number of investors disinvest – take the money and run – it would seem that the market would amount to a massive and self-propelled Ponzi scheme in which investors have fooled themselves by reinvesting the funds they receive back into existing firms at ever higher stock prices (for the most part).

Musings on Markets

OCTOBER 12, 2023

That delusion running deepest among pension funds, insurance companies, for-profit fund managers and diversified financial investors, who also happen to account for 78% of all impact investing funds. As concerns about climate change have risen, the money invested in alternative energy companies has expanded, with $5.4

ThomsonReuters

MARCH 10, 2021

Increases the paid sick and family leave credit by the cost of the employer’s qualified health plan expenses and by the employer’s collectively bargains contributions to a defined benefit pension plan and the amount of collectively bargained apprenticeship program contributions. The money will be available until expended.

Reynolds Holding

FEBRUARY 14, 2024

Pension funds and other institutional investors rail against dual-class shares and other tiered voting structures while companies fight vigorously to defend them. 6] Opposing or supporting voting differences is one thing, but actions taken with real money count in the market for consumer goods as well as for investment vehicles.

Brian DeChesare

APRIL 5, 2023

When you ask most people about their “career goals,” they sound something like this: Make a lot of money or gain power/prestige. CPP in Alberta (Canada) is another interesting name that could be on this list, but there’s some debate over whether it’s a sovereign wealth fund or a pension fund. Take little-to-no risk.

Farrel Fritz

NOVEMBER 27, 2023

Second , the Court granted Christine summary judgment on liability and damages for faithless servant, writing: It can be easily concluded — in fact the conclusion is inescapable — that rather than simply negotiating to pay the Marital Trust a reasonable amount of money for ROHM back when he purchased the skilled nursing facilities in 2016.,

Reynolds Holding

DECEMBER 6, 2022

Institutional investors – including one of Canada’s largest pension funds – are poised to take massive write-offs of their investments in FTX. At least one crypto lending firm, BlockFi , has recently filed for bankruptcy due to a liquidity crisis. Meanwhile, the ripple effects extend far beyond the crypto market.

Brian DeChesare

APRIL 10, 2024

The Top Sports Private Equity Firms Sports-Focused Private Equity Firms Larger, Diversified Funds That Also Invest in Sports Sovereign Wealth Funds and Pension Funds Conglomerates and Holding Companies Family Offices and Individuals How Do Sports Private Equity Deals Work? Examples include Ares (now with a $3.7

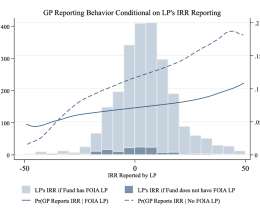

Reynolds Holding

MAY 9, 2022

Venture capital (VC) has become an increasingly important asset class for institutional investors such as endowments, pension funds, insurance companies, and sovereign wealth funds, as well as for wealthy individuals. A large amount of money is involved: U.S. VC-backed companies raised nearly $300 billion in 2021.

Reynolds Holding

APRIL 13, 2022

Private Funds : Exams observed that more than 5,000 registered investment advisers (RIAs) manage roughly $18 trillion in private fund assets in strategies that include hedge funds, private equity funds, and real estate funds, whose investors include state and local pensions, family beneficiaries, charities, and endowments.

Musings on Markets

JANUARY 29, 2021

For those of you tempted to put all of Wall Street into one basket, it is worth noting that the biggest segment of professional money management still remains the mutual fund business, and mutual funds are almost all restricted to long only positions. But what if you think a stock is too highly priced and is likely to go down?

Reynolds Holding

APRIL 28, 2022

With nearly half of the households in the United States having their pension plans and life savings invested in mutual funds, understanding the risk-taking behavior of mutual funds is thus of prime importance for investors.

Brian DeChesare

FEBRUARY 22, 2023

They all raise money from Limited Partners (LPs), such as pension funds, sovereign wealth funds, endowments, and insurers, and invest in companies and securities. They earn money from a management fee charged on their assets under management (AUM) and a performance fee, often 20% of the profits above a certain hurdle rate.

Reynolds Holding

FEBRUARY 6, 2023

2009); Asbestos Workers Local 42 Pension Fund v. 2d at 370 (entertaining a claim that the company failed to put into place policies and procedures to ensure compliance with anti-money laundering obligations but determining that such policies and procedures actually existed). [9] Laborers Pension Fund v. Ritter, 911 A.2d

Farrel Fritz

JUNE 5, 2023

However, where Plaintiff alleges that the directors of a Delaware corporation breached their fiduciary duties, the issues pertaining to whether Plaintiff has met the threshold for pleading demand futility will be decided under Delaware substantive law”]; Stephen Blau MD Money Purchase Pension Plan Tr.

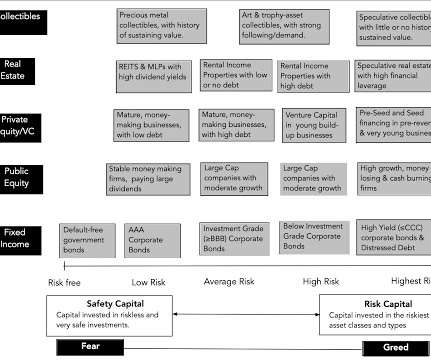

Musings on Markets

JULY 1, 2022

For others, it can be the portion of their capital with the longest time horizon (pension fund savings or 401Ks, if you are a young investor, for example), where they believe that any losses on risk capital can be made up over time. Risk Capital: Historical Perspective How do you track the availability and access to risk capital over time?

Reynolds Holding

MAY 12, 2024

banks; [4] consumer finance lenders licensed under Chapter 516 of the Florida Statutes; and money services businesses licensed under Chapter 560 of the Florida Statutes. [5] 5] Fair Access Provisions and Related Attestations. 28] Rulemaking Authority. 32] Unlike Florida’s fair access statute, however, “services” exclude loans. [33]

ThomsonReuters

DECEMBER 22, 2020

Unlike the 2018–19 version of this relief, the 2020 version also refers to the Thrift Savings Plan for federal employees and to money purchase pension plans. It does not apply to areas that are disaster areas solely due to the COVID-19 pandemic—relief for that disaster was provided in the CARES Act. Student Loan Repayments.

Reynolds Holding

JULY 17, 2023

293 (1946) as a seminal case construing “investment contract,” Quoting from Howey , the opinion interprets an investment contract as “a contract, transaction[,] or scheme whereby a person [(1)] invests his money [(2)] in a common enterprise and [(3)] is led to expect profits solely from the efforts of the promoter or a third party.” [4]

ThomsonReuters

SEPTEMBER 7, 2023

Money contributed to these programs is not subject to federal income tax, Social Security tax, or Medicare tax. This means that the money you receive to cover the expenses of caring for foster children is not subject to federal income tax. Some employers offer dependent care assistance programs as a benefit to their employees.

Cooley M&A

DECEMBER 3, 2019

For a seller, R&W insurance significantly lowers the amount of money the seller must place in escrow to cover its post-closing indemnification obligations (approximately 0.5% to 1% of the purchase price as compared to a 10% escrow). Policies do not cover “known issues” (i.e.

Reynolds Holding

AUGUST 9, 2022

Many scholars have criticized the SVM paradigm, arguing that managers should act in the interest of other stakeholders – workers, consumers, the community – or that companies should have a social purpose over and above making money. These criticisms are normative. In a new paper, we examine the intellectual case for SVM. 1] In 2014 the U.S.

Brian DeChesare

OCTOBER 12, 2022

Solid Limited Partner (LP) relationships at endowments, pensions, funds of funds , family offices , sovereign wealth funds, etc., And you’ll still market your new fund to funds of funds, endowments, pensions, family offices, and high-net-worth individuals. so you can raise the required capital. In the U.S.

Reynolds Holding

NOVEMBER 8, 2023

Second, the regulatory framework for CITs developed within the context of defined-benefit pension plans, which are increasingly rare in the private sector. 3] Brian Croce, House Committee Advances Bill Allowing 403(b) Plans to Offer CITs , Pensions & Invs., 8] The OCC never did enact such rules for CITs. . & & Pol’y Stud.,

Musings on Markets

JANUARY 19, 2022

Across the United States, defined-benefit pension funds that have set aside funds on this same assumption will face massive funding shortfalls, unless they reevaluate benefit levels or infuse new funds.

Class VI Partner

JULY 28, 2021

Current Liabilities can be contrasted with Long-Term Liabilities, which have maturities of greater than one year and typically consist of debt instruments and other longer-term deferred liabilities (pension liabilities sometimes fall into this category). Debt Service All debt has two components: interest and principal.

Brian DeChesare

NOVEMBER 30, 2022

And while the salary + bonus + carried interest levels are high, you probably don’t want to stay in a job you dislike for 10+ years just to make money. You get good at making money from mispriced assets, but you lose some of the soft skills required in PE, which means pursuing the other exit options on this list can be difficult.

Reynolds Holding

AUGUST 10, 2023

Both asset owners and fund managers have fiduciary duties to ensure money is managed in the best interests of the beneficiaries or of the fund, but they may see and fulfil those duties differently. It is their hard-earned money that is being used to make investments and prop up those managers in the first place.

Reynolds Holding

MAY 1, 2023

State Street was not alone in its efforts; indeed, major public pension funds had spearheaded the initial effort to increase board diversity. In this debate, the role of institutional investors is complicated by their status as intermediaries that manage other people’s money.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content