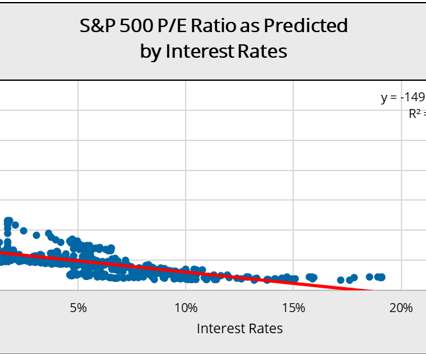

The Relationship Between S&P 500 P/E Ratios and US Interest Rates

Value Scope

NOVEMBER 17, 2022

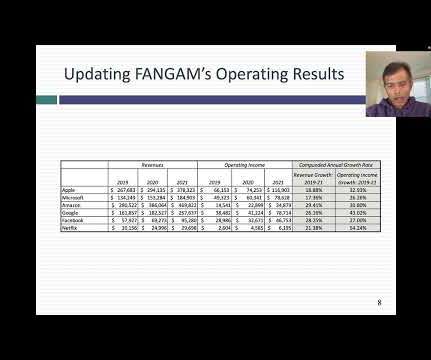

The P/E ratio can be described as the ratio between current share price and per-share earnings. Earnings in the S&P 500 are calculated using the 12-month earnings per share of “current” earnings. A higher P/E ratio suggests that investors expect higher earnings growth in the future. However, only 22.4%

Let's personalize your content