Growth Equity: The Child Prodigy of Private Equity and Venture Capital, or an Artifact of Easy Money?

Brian DeChesare

MARCH 13, 2024

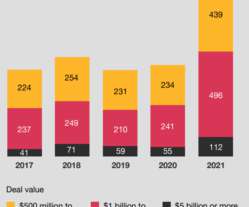

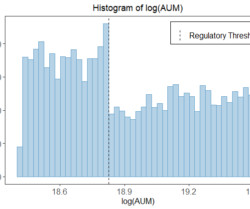

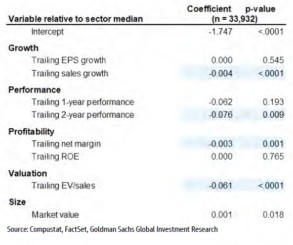

Over the past few decades, growth equity (GE) has gone from an afterthought to a major asset class for huge investment firms. Others would counter that growth equity’s rapid ascent was mostly due to the easy money that persisted between 2008 and 2021. The Top Growth Equity Firms Why Did Growth Equity Get So Popular?

Let's personalize your content