Financing Year in Review: Evolving Markets and New Trends

Harvard Corporate Governance

FEBRUARY 8, 2024

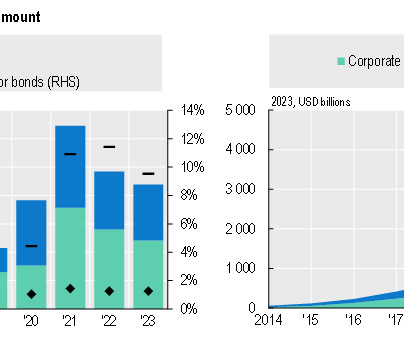

Widely held concerns about inflation, rising interest rates, and a possible recession combined to slow debt financing and deal activity in the first half of 2023. Private equity sponsors, in particular, held back on debt-financed leveraged buyouts while watching to see whether interest rates (or business valuations) would fall.

Let's personalize your content