Good (Bad) Banks and Good (Bad) Investments: At the right price.

Musings on Markets

MAY 7, 2023

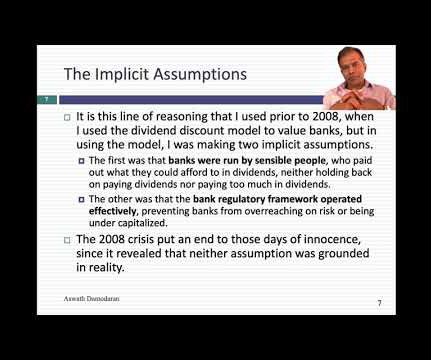

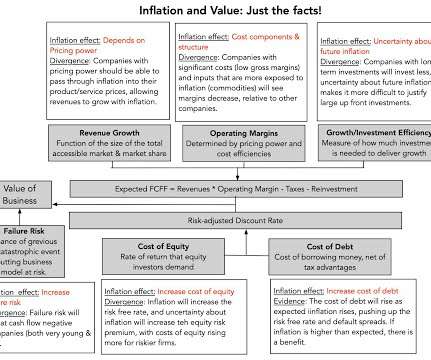

In this post, I will begin by looking at how to value banks and follow up with an examination of investor views of banking have changed, by looking at pricing, before examining divergences in how banks are priced in the market today. All Equity, All the time!

Let's personalize your content