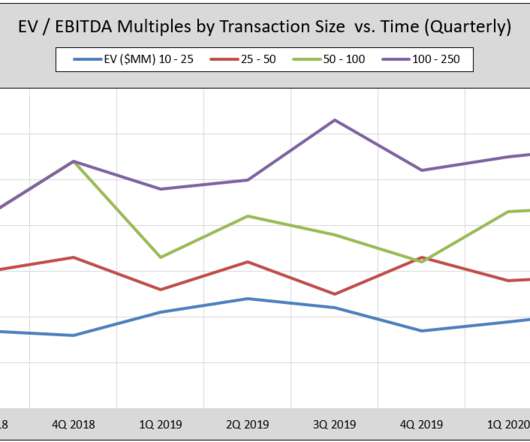

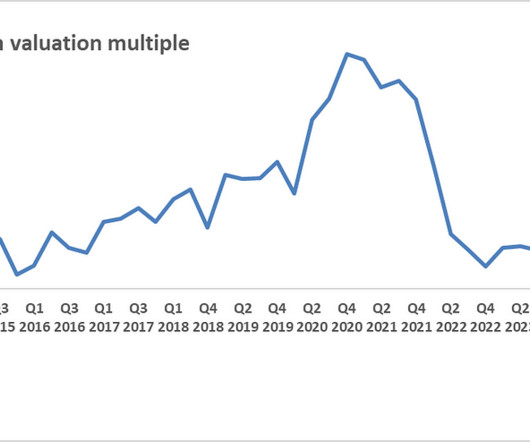

[PARAMETERS UPDATE P5.8] EBITDA MULTIPLES

Equidam

FEBRUARY 16, 2024

You can refer to the table below to see how the EBITDA multiples for the industries available on the Equidam platform will change on February 29th, 2024. Industry EBITDA Multiple Old New Var % Advanced Medical Equipment & Technology 20.99 21.44 ↑ 2.14% Advertising & Marketing 10.55 12.85 ↑ 35.55% Airlines 10.98

Let's personalize your content