AI technology, a serious threat for Alphabet?

Valutico

FEBRUARY 21, 2023

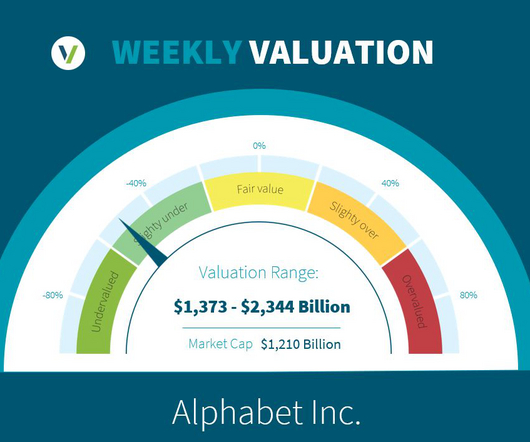

is an American tech conglomerate, operating in various industries, including technology, advertising, autonomous driving, entertainment, and many more. The company is one of the world’s largest companies with a market capitalization of $1.34 The post AI technology, a serious threat for Alphabet?

Let's personalize your content