Valutico Leverages EMIS Transaction Data to Enable Better Valuations of Emerging Market Deals

Valutico

NOVEMBER 7, 2023

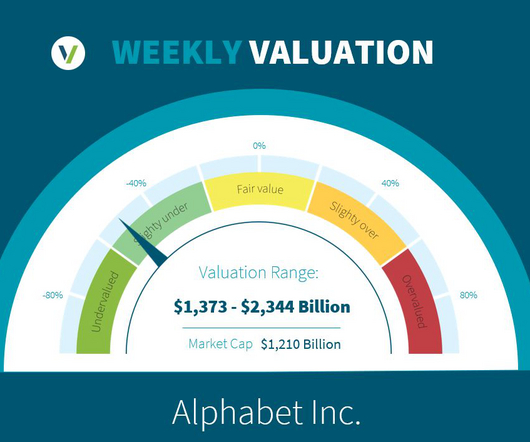

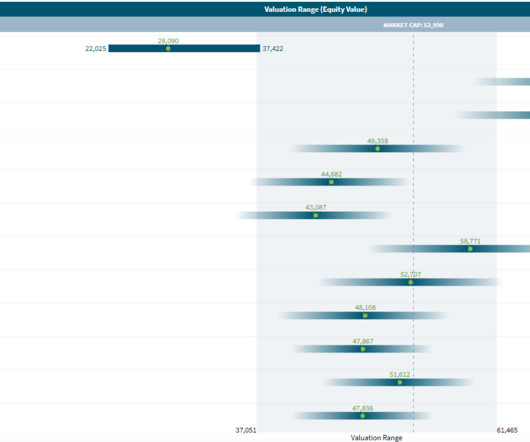

Valutico Leverages EMIS Transaction Data to Enable Better Valuations of Emerging Market Deals Valutico, a leading valuation software provider, is now offering EMIS comprehensive mergers and acquisitions data to help users better assess the deal landscape, drive deal flow and capitalise opportunities in the world’s fastest-growing markets.

Let's personalize your content