EBITDA Adjustments – 5 Of The Most Common Adjustments In Middle Market M&A

Benchmark Report

JULY 21, 2023

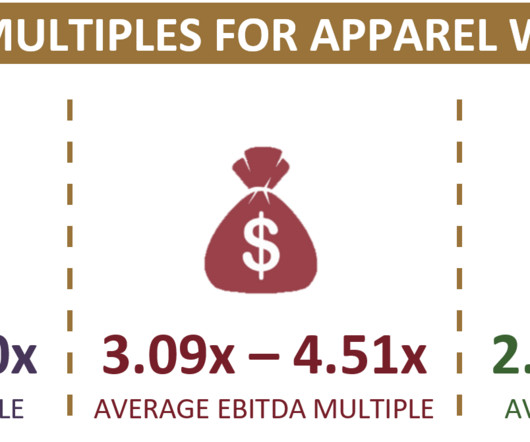

Correctly calculating adjusted EBITDA is essential in an M&A transaction, and all parties must be familiar with the adjustments. EBITDA is used to evaluate a company’s profitability of its core operations by removing items dependent on capital structure, such as interest,

Let's personalize your content