M&A Deal Terms: Average Capital Structure

Exit Strategy

MARCH 31, 2022

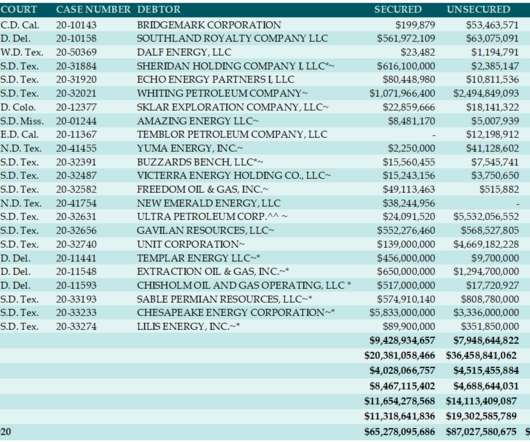

The following chart from GF Data shows the average capital structure over the past 5 years for middle market business acquisitions. The post M&A Deal Terms: Average Capital Structure appeared first on Exit Strategies Group, Inc. Overall there was a slight rise during COVID, but nothing major.

Let's personalize your content