Oneok shakes up the midstream industry

Valutico

MAY 24, 2023

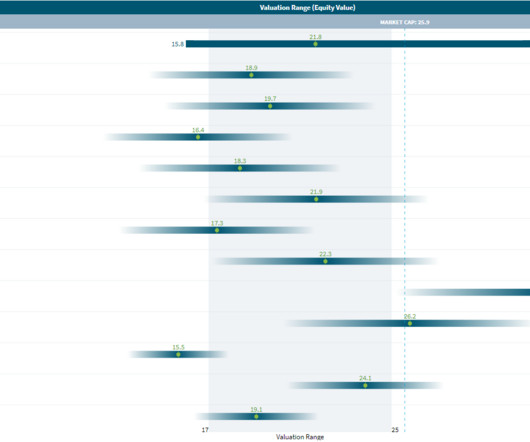

Connecting NGL supply across the Mid-Continent, Permian, and Rocky Mountain regions to vital market centers, Oneok plays a pivotal role in the country’s energy industry. 2022 saw a robust cash and capital structure with a staggering USD 967 million adjusted EBITDA in Q4, up by 14% from the previous year.

Let's personalize your content