EBITDA: What’s It Worth?

IBG Business

NOVEMBER 30, 2022

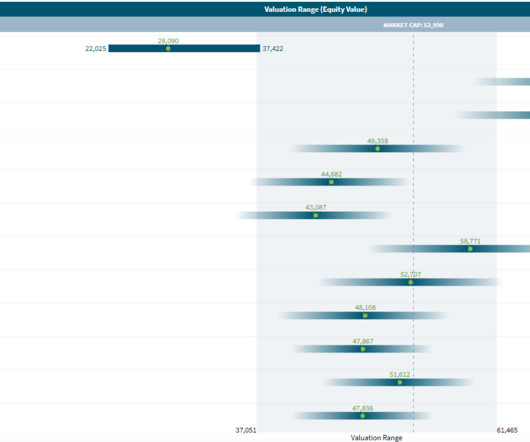

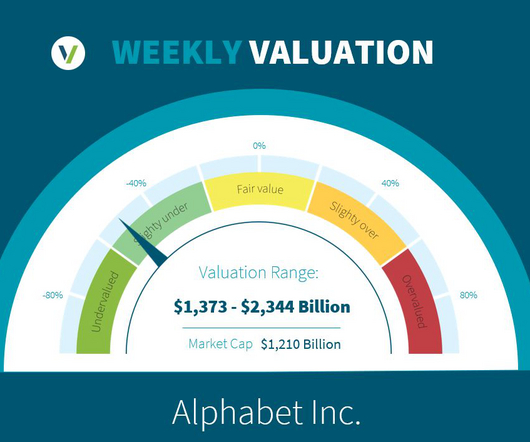

EBITDA: What’s It Worth? Frequently, the answer is tied to a multiple of EBITDA (earnings before interest, taxes, depreciation and amortization), leaving the further question, “What is EBITDA worth as a key factor in value metrics?”. EBITDA is probably the most common approach today. Johnson , M&AMI.

Let's personalize your content