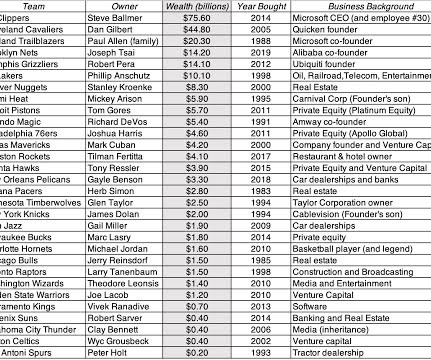

Toys for Billionaires: Sports Franchises as Trophy Assets!

Musings on Markets

AUGUST 25, 2023

Broadcasting upheaval : As the revenues from sports has shifted from the playing fields to media, it is the size of the media contracts that determine how lucrative a sport is. Thus, it should come as no surprise that when the two connect, as is the case when teams are bought and sold, or players are signed, I am doubly interested.

Let's personalize your content