What Is A Sustainable Growth Rate?

Benchmark Report

JUNE 20, 2022

As a business owner, it is important to have a solid understanding of what a sustainable growth rate (SGR) is, and why it matters to the valuation of your company.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

what-is-a-sustainable-growth-rate

what-is-a-sustainable-growth-rate

Benchmark Report

JUNE 20, 2022

As a business owner, it is important to have a solid understanding of what a sustainable growth rate (SGR) is, and why it matters to the valuation of your company.

Valutico

AUGUST 30, 2023

Terminal Growth Rate – A Simple Explanation with Formula The Terminal Growth Rate is often used in valuation models and financial projections, but what is it and why is it important? What is the Terminal Growth Rate? What is the Terminal Growth Rate?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Equidam

SEPTEMBER 13, 2023

Building a startup into a sustainable business requires multiple years of commitment. Benchmarks to estimate the growth rate for startups Forecasting revenues really comes down to a growth rate. From these, we are able to study the annual revenue growth coefficients for the upcoming 3 years.

Lighter Capital

AUGUST 10, 2023

At Lighter Capital, we don’t rely on valuations in our financing model, but we thought it would be useful to talk about valuations as they relate to SaaS companies, because they help founders manage their cash runway to achieve long-term sustainable growth. Below we explore how SaaS multiples are determined.

Lighter Capital

AUGUST 17, 2023

Funding deals and deal values are a fraction of what they had been. When startup funding dries up , what do you do? When forecasting cash flow and runway, ask yourself: What do I need just to survive versus increasing revenue? It feels like the right time to raise some cash. There’s a problem, though.

Lighter Capital

AUGUST 16, 2023

What is revenue churn? What's the difference between gross and net revenue churn? Some SaaS businesses may have strong enough growth from their installed customer base to offset revenue losses — something you can see with net revenue churn but not gross revenue churn — and that valuable insight guides smarter business decisions.

Lighter Capital

SEPTEMBER 28, 2023

When “growth at any cost” was the name of the game in tech, founders could breeze by without calculating and comparing their startup’s EBITDA margin. What is a good EBITDA margin percentage? What is considered good ? If your EBITDA margin is 10%, your SaaS startup’s operations may not be sustainable.

Benzinga

DECEMBER 8, 2023

08, 2023 (GLOBE NEWSWIRE) -- Biostimulants are substances or microorganisms applied to plants, seeds, or the surrounding soil to enhance the plant's growth, development, and overall health. What is the market for biostimulants ? billion Progress Rate CAGR of 11.8% billion Progress Rate CAGR of 11.8% Chicago, Dec.

Equidam

MARCH 20, 2024

Essentially, it’s through understanding the economic energy your company can unlock, which can be viewed through four lenses: Value Proposition: business model perspective In a basic sense, the value that your company provides plays a pivotal role in customer acquisition and growth.

Chris Mercer

MAY 19, 2023

What really happened? What caused SVB to fail? SVB was on a self-imposed path to destruction that had been in place and waiting for an adverse change in the economy or a rising interest rate environment to kick it into oblivion. Introduction The failure of Silicon Valley Bank will be talked about for years.

Lighter Capital

AUGUST 12, 2023

Look at your customer churn rate (CCR). What is customer churn rate? The customer churn rate is the percentage of customers that cancel their subscriptions in a given time period. Also don't neglect looking for the positives in your analysis, like trends that reveal strategies for sustainability. 12 ÷ 50 = 0.24

Lighter Capital

AUGUST 10, 2023

That can be challenging for founders who are often just learning about managing cash burn — that is, strategically controlling the rate at which they spend the money they have. You don’t want to run so lean that you miss growth opportunities to lose out to aggressive competitors.

Scott Mashuda

NOVEMBER 13, 2023

The Rising Cost of Debt: What this means for Entrepreneurs The cost of debt, encompassing interest payments and associated expenses, is a critical factor that influences a company’s financial decisions. Although headlines suggest a slowdown in M&A activity, the lower middle market continues to be very active.

Startup Valuation Blog

MARCH 15, 2022

When you open up a new business, you are always unsure about the success rate of the business. The startup time of the business is the high time that analyzes the future success rate of the business. Any decision that is made in the startup period of the business has an effect on its future growth. Introduction.

ThomsonReuters

APRIL 25, 2024

What are some 401(k) tax benefits? How to engage with clients on 401(k) tax considerations What are the taxes on 401(k) withdrawals? How to engage with clients on 401(k) tax considerations What are the taxes on 401(k) withdrawals? What is the 401(k) tax limit? What should I know about after-tax 401(k) contributions?

Startup Valuation Blog

DECEMBER 15, 2021

Luckily, we have compiled the most influential factors that will change the future for your startup, and taking care of these factors will surely increase the value of your startup: 1. Burn rate Of The Startup. Thus, you need to keep track of your burn rate to ensure that your business keeps on running without any obstruction.

Valutico

APRIL 25, 2023

With this groundbreaking announcement, the valuation platform Valutico has made a significant step into integrating sustainability into the widespread practice of valuing businesses. Analysts can identify priority areas for improvement, such as reducing greenhouse gas emissions, managing water usage, and increasing recycling rates.

Viking Mergers

FEBRUARY 23, 2023

This dip in final-quarter deals is likely due to uncertainty related to rising inflation, steadily increasing interest rates, a possible economic downturn from the effects of the pandemic, and geopolitical issues from the War in Ukraine. In this article, we’ll take a closer look at the sectors indicating growth for best-selling businesses.

Sun Acquisitions

FEBRUARY 28, 2024

The business world is dynamic, and growth often requires expanding one’s portfolio through strategic acquisitions. Ask yourself questions like: What are your goals? Consider factors such as market position, financial health, growth potential, and compatibility with your existing operations.

ThomsonReuters

JULY 25, 2023

Every company’s tax technology journey is different, and it’s not always clear when and how tax automation should be incorporated or what the benefits will be. Thomson Reuters: If a business is doing tax determination and rate management manually, is it feasible that the tax team can keep up?

Reynolds Holding

MARCH 7, 2023

The steady growth of sustainable finance in recent years poses difficult questions on how regulators should approach it. In the European Union (EU), for example, there has been an explosion of new rules aimed at addressing a broad array of concerns about investors’ reliance on the quality of sustainable financial products.

Lighter Capital

FEBRUARY 1, 2023

Everybody knows what venture capital is, but many entrepreneurs are fuzzier about its loan-based cousin, venture debt. What is venture debt? Venture debt is, as the name implies, a debt funding mechanism available only to venture-backed, early- and growth-stage startups. There is no venture debt without venture capital.

Lighter Capital

OCTOBER 15, 2023

For many young SaaS businesses, strategic investments in marketing, sales, and customer support can drive scaled growth in annual recurring revenue (ARR) that propels the business to its next big milestone. This 2x2 matrix offers a simple yet effective framework for planning and implementing growth strategies that’s still widely used today.

Equilest

APRIL 24, 2024

For partners within the business, a buyout can provide an opportunity to consolidate control, streamline decision-making processes, or pursue alternative growth strategies. However, there may come a time when investors or partners decide to exit their involvement in a venture, either through a buyout or a buy-in.

Equilest

NOVEMBER 18, 2023

What role does technology play in determining the value of a security alarm company? How do industry trends affect the valuation process? Is customer retention more important than acquiring new customers for valuation? Is customer retention more important than acquiring new customers for valuation?

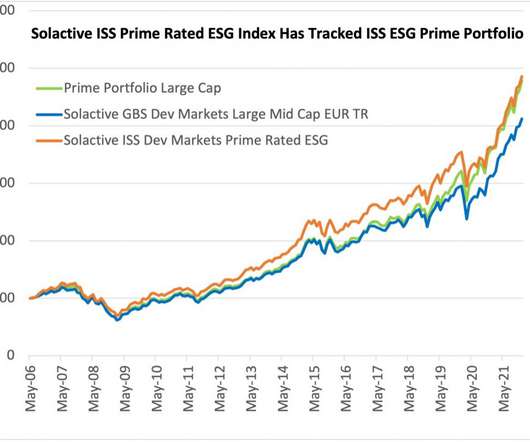

Harvard Corporate Governance

OCTOBER 28, 2022

For example, is a hypothetical company that produces so-called “green” technology but has substantial worker safety issues a better ESG investment than an energy company whose products promote economic growth and result in the reduction of poverty, famine, and suffering? Posted by Mark T. Uyeda, U.S. Uyeda is a Commissioner at the U.S.

Reynolds Holding

JUNE 21, 2022

While the proposed changes to the Names Rule are ostensibly engendered by the growth in ESG-marketed funds, the proposal also captures other funds that have historically been out of scope of the Names Rule. In a departure from its historical approach, the SEC now proposes to extend the 80% investment policy (i.e.,

Sun Acquisitions

MARCH 26, 2024

With the rise of mergers and acquisitions (M&A), a strategic approach by MedSpa owners can significantly bolster their customer retention rates. This article delves into how Medspa business owners can leverage M&A to acquire companies with loyal customer bases, thus enhancing their growth and customer loyalty.

Lighter Capital

JULY 20, 2023

While a well-capitalized venture with several million dollars in the bank can behave like a large, established company from the jump, a bootstrapped startup has to manage cash more carefully, growing at a rate they can afford and control. It’s best to start with the basics.

Value Scope

APRIL 9, 2021

If I buy a rare sports car for, say, $100,000, and I get to view it every time I walk into the garage, what is its value? And what is the value of the pleasure I derive from the car, the drive, the fun, and its aesthetic beauty? Similarly, what about a painting on the wall? 1] But the concept of value is complex.

Value Scope

APRIL 9, 2021

If I buy a rare sports car for, say, $100,000, and I get to view it every time I walk into the garage, what is its value? And what is the value of the pleasure I derive from the car, the drive, the fun, and its aesthetic beauty? Similarly, what about a painting on the wall? Transcending Fair Market Value. It transcends FMV.

Lighter Capital

SEPTEMBER 26, 2023

Capital is essential to drive operations and fuel growth. Though they would get lower rates and pay less overall with a 15-year mortgage, many people opt for a 30-year mortgage, because it’ll leave them with more available cash each month. Though equity funding does have advantages for certain startups, it also has disadvantages.

Audit Board

JUNE 3, 2022

These risks, however, are also opportunities for growth – to become the ethical, inclusive, and sustainable workplaces that not only manage risk, but proactively increase their stakeholders’ quality of life. Read on to learn more about what an ESG audit entails and our preliminary ESG audit checklist. . What Is an ESG Audit? .

Musings on Markets

JANUARY 19, 2022

Leading into 2021, the big questions facing investors were about how quickly economies would recover from COVID, with the assumption that the virus would fade during the year, and the pressures that the resulting growth would put on inflation. the 2019-21 time period would rank 8th on the list of 92 3-year time periods.

Musings on Markets

MAY 6, 2022

In fact, the average inflation rate in the 2011-20 decade was the lowest of the seven decades that I cover in this chart. The nature of markets is that they are never quite settled, as investors recalibrate expectations constantly and reset prices.

Sun Acquisitions

FEBRUARY 14, 2024

What works for one purchase may be different from another. Growth and Expansion: If your primary objective is to expand your business and penetrate new markets, your financial strategy should reflect this ambition. These strategies can provide the financial firepower needed to fuel growth.

Equilest

FEBRUARY 3, 2024

Revenue growth, profit margins, and customer acquisition cost are key indicators of financial health. A company exhibiting consistent growth and efficient cost management is likely to be valued higher in the market. Factors Influencing the Value Several factors significantly influence the value of cybersecurity software companies.

Equilest

DECEMBER 10, 2022

What is a Forward outlook, and How Can It contribute to the Growth Rate In DCF Model? One of the most significant elements of the cash flow discounting method is the company's growth rate. . The growth rate is often thought of as the historical growth rate. Let's discuss.

Equilest

JANUARY 6, 2024

Explore the metrics that experts scrutinize, such as revenue growth, profit margins, and operational efficiency, to gain a holistic view of a 3PL company's financial health. What role does technology play in determining a 3PL company's value? Can a 3PL company's environmental sustainability affect its valuation?

Reynolds Holding

MAY 4, 2023

6] As the Kentucky AG notes when citing this piece of scholarship, “ESG investing is an ‘umbrella term that refers to an investment strategy that emphasizes a firm’s governance structure or the environmental or social impacts of the firm’s products or practices.’” [7] What goes unsaid is a complete depiction of the umbrella.

ThomsonReuters

APRIL 25, 2024

As an accountant, advising your clients on retirement income taxes and related strategies can help them to optimize their financial planning in their golden years. From an accountant’s perspective, the answer to this question varies depending on the source of the income and applicable tax laws. Convert to a Roth IRA. Delay Social Security.

Equidam

APRIL 3, 2024

At the heart of every conversation between AI startup founders and potential investors, lies a question that neither side feels particularly confident answering: “What is the market size?” By focusing on value, not just numbers, founders can engage VCs in a meaningful conversation about what makes the startup stand out.

Equidam

JANUARY 26, 2022

The number of prospects contacted and that incredibly premature conversion rate. The viability, investability and valuation of your startup are heavily dependent on growth potential and final profitability margin. In the early days of a startup, financial projections seem like fantasy. Vague, imprecise… a total waste of time.

Lighter Capital

FEBRUARY 12, 2024

This easy-to-follow guide will explain how equity is diluted in fundraising, founder dilution at different growth stages, and how to assess the cost of selling equity. Equity dilution is simply the result of supply and demand. Equity dilution occurs when new shares in a company are issued to individuals or entities.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content