Structure for SPACs: SEC Publishes Final Rules

Harvard Corporate Governance

MARCH 16, 2024

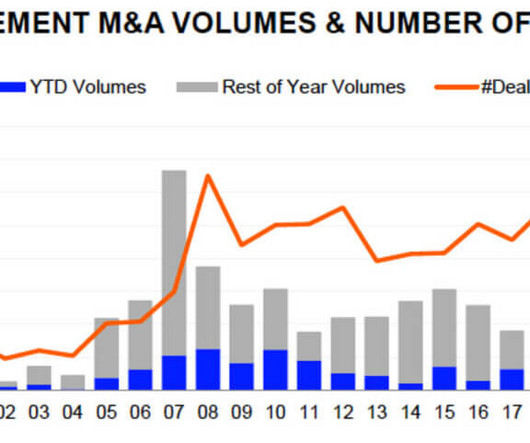

The SEC issued the nearly 600-page release just prior to the second anniversary of their issuance of the related proposed rules, which we discussed in our prior memo. In that interim period, the volume of SPAC IPOs and de-SPAC transactions have declined meaningfully for a variety of reasons.

Let's personalize your content