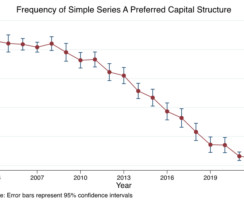

Learning by Investing: Entrepreneurial Spillovers from Venture Capital

Harvard Corporate Governance

JANUARY 17, 2024

Schiff Professor of Investment Banking at Harvard Business School; Jinlin Li is a Postdoctoral Research Fellow at Harvard Kennedy School and Harvard Business School; and Tong Liu is the Judy C. The academic literature on entrepreneurial finance has largely treated investors and entrepreneurs as distinct identities. more…)

Let's personalize your content