SEC Adopts Final Rules on Cybersecurity Disclosure

Harvard Corporate Governance

AUGUST 9, 2023

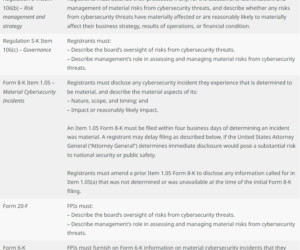

The guidance addressed disclosure obligations under existing laws and regulations, cybersecurity policies and procedures, disclosure controls and procedures, insider trading prohibitions and Reg FD and selective disclosure prohibitions in the context of cybersecurity.

Let's personalize your content