Do Favorable ESG Ratings Lead to More Socially Responsible Behavior?

Reynolds Holding

NOVEMBER 20, 2022

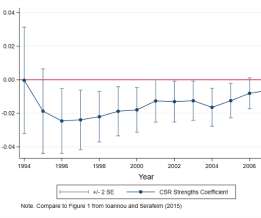

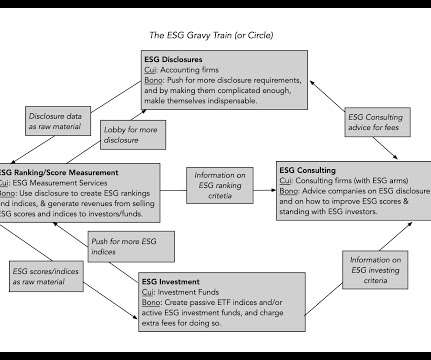

One of the hottest topics in the business world is ESG ratings, which are designed to measure the environmental, social, and governance risks of a company. Yet research on whether these ratings actually work is surprisingly sparse. Yet research on whether these ratings actually work is surprisingly sparse.

Let's personalize your content