The CEO Shareholder: Straightforward Rewards for Long-term Performance

Harvard Corporate Governance

OCTOBER 23, 2023

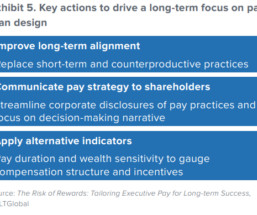

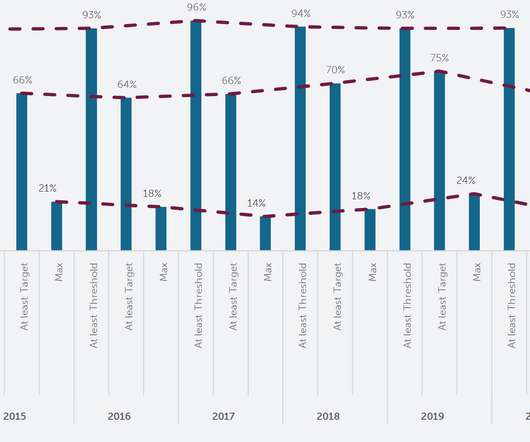

Related research from the Program on Corporate Governance includes Paying for Long-Term Performance (discussed on the Forum here ) by Lucian Bebchuk and Jesse Fried. Shareholders and their advisors similarly focus on short-term returns as a primary metric in the evaluation of pay plans. more…)

Let's personalize your content