Appraiser Newsroom - Untitled Article

Appraiser Newsroom

MAY 1, 2024

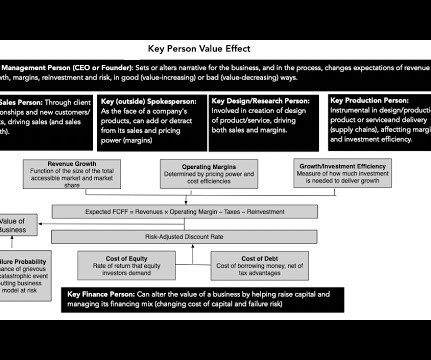

Whether it’s for tax planning, regulatory compliance, mergers and acquisitions, or financial reporting purposes, understanding the nuances of legal entity valuations is essential. Transfer pricing valuations necessitate careful analysis of comparable transactions to ensure arm’s length pricing.

Let's personalize your content