Private Equity Mega-Funds: The Best of the Best?

Brian DeChesare

FEBRUARY 9, 2022

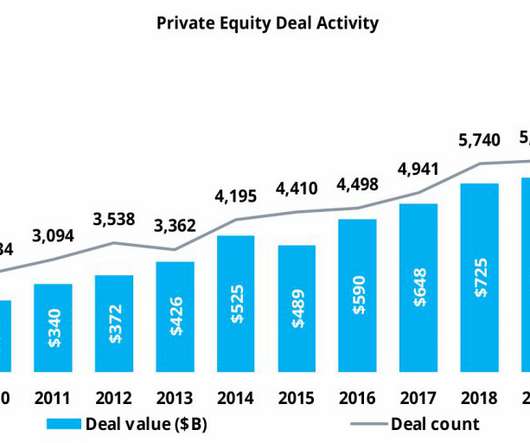

Ask the average student or professional in the finance industry about their long-term career goal, and they’ll usually say, “ private equity mega-funds. ”. Similar to middle market private equity , though, there are some definitional problems here. Definitions: What is a Private Equity Mega-Fund?

Let's personalize your content