The Corporate Calendar and the Timing of Share Repurchases and Equity Compensation

Harvard Corporate Governance

APRIL 28, 2022

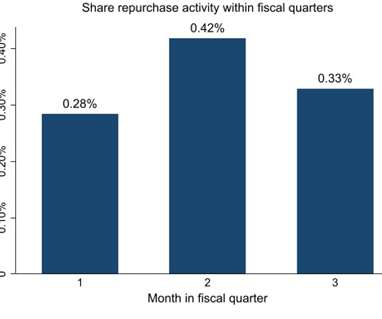

The growth in buyback volumes over the past two decades has raised concerns that CEOs are misusing share repurchases to maximize their own personal wealth at the expense of long-term shareholder value. In our paper , we take a fresh look at the question of whether CEOs use share buybacks to sell equity at inflated stock prices.

Let's personalize your content