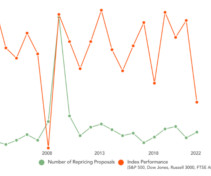

Back to the Future: Option Repricing

Harvard Corporate Governance

APRIL 16, 2023

Its close cousin, the option exchange, replaces outstanding stock options with new stock options with lower exercise prices than those of the stock options they replaced. Repricing boils down to revising the exercise price of outstanding options awards to a lower (and thus more attainable) level. more…)

Let's personalize your content