Fixed Income Research: The Overlooked Younger Brother of Equity Research?

Brian DeChesare

FEBRUARY 28, 2024

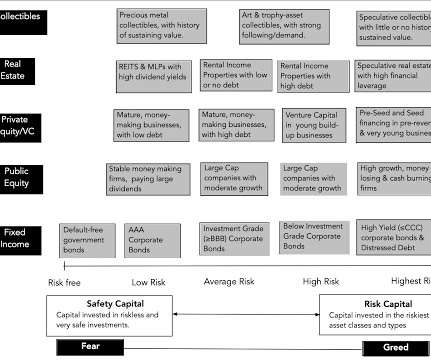

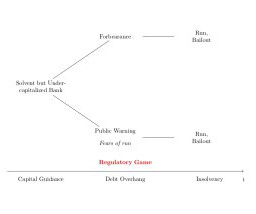

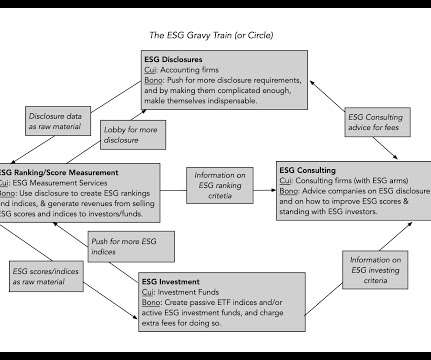

The confusing part is that fixed income research exists at banks (“ sell-side roles ”), buy-side firms such as asset managers and hedge funds , and even credit rating agencies, and each one differs. If the company liquidates, which lenders will get their money back? Also, it can be quantitative or fundamental – or both! –

Let's personalize your content