EV/EBITDA Explained: A Key Valuation Multiple for Investors

Valutico

MAY 19, 2025

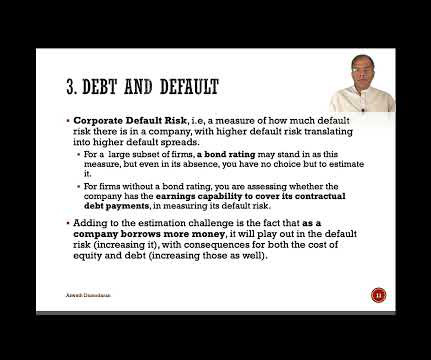

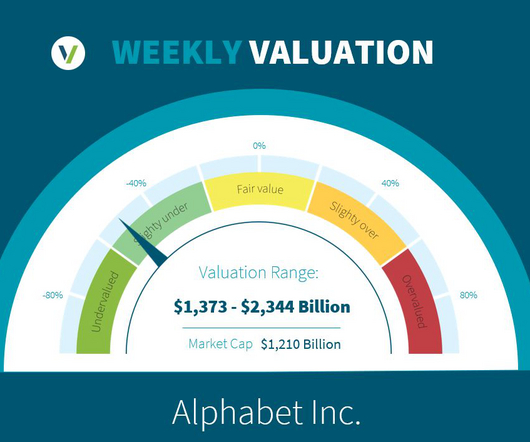

EV typically includes Market Capitalization, Debt, Minority Interest, and Preferred Equity, minus Cash & Cash Equivalents. A primary advantage is providing a “debt-neutral” valuation, making comparisons easier between companies with different capital structures. What is Adjusted EBITDA?

Let's personalize your content