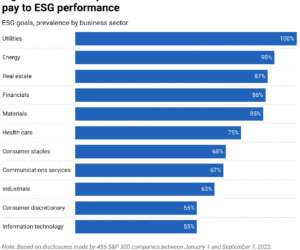

Linking Executive Compensation to ESG Performance

Harvard Corporate Governance

NOVEMBER 27, 2022

These concerns have now been compounded by skepticism about whether ESG can actually drive financial performance for companies and investors alike. [3]. This post is based on her Conference Board memorandum, in partnership with ESG analytics firm ESGAUGE and compensation advisory firm Semler Brossy. Introduction. Insights for What’s Ahead.

Let's personalize your content