Valuing Intangible Assets: Challenges and Considerations in Business Valuation

RNC

JUNE 14, 2023

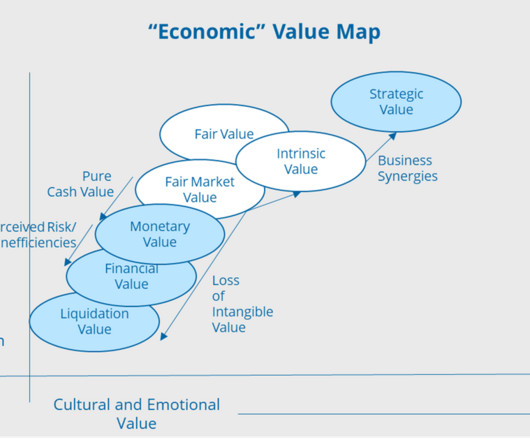

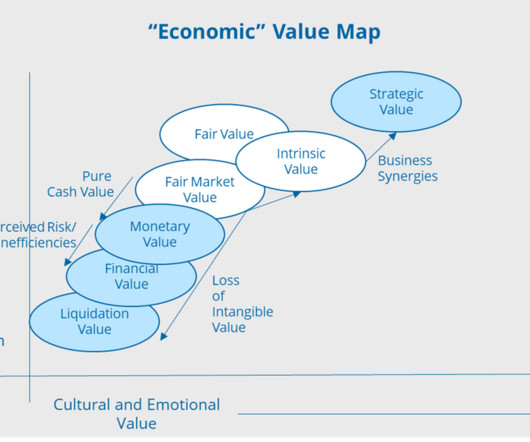

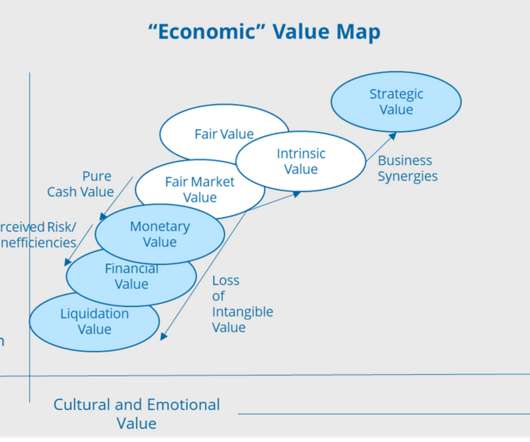

However, while tangible assets such as property and equipment are relatively straightforward to evaluate, intangible assets present a unique set of challenges. Intangible asset valuation has emerged as a vital aspect of business valuation, requiring careful consideration and expertise.

Let's personalize your content