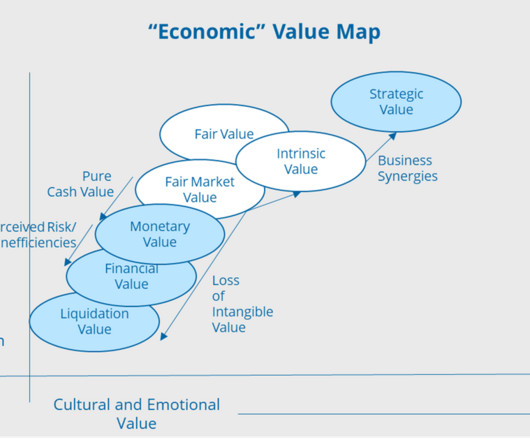

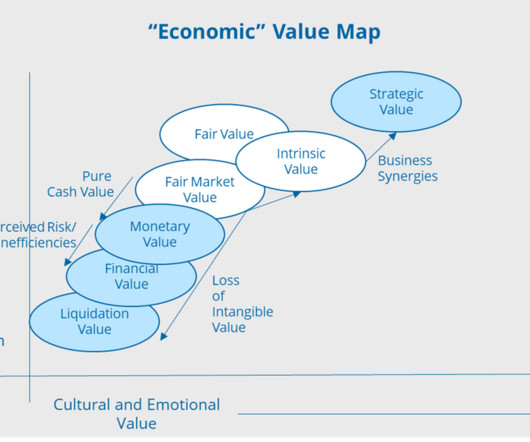

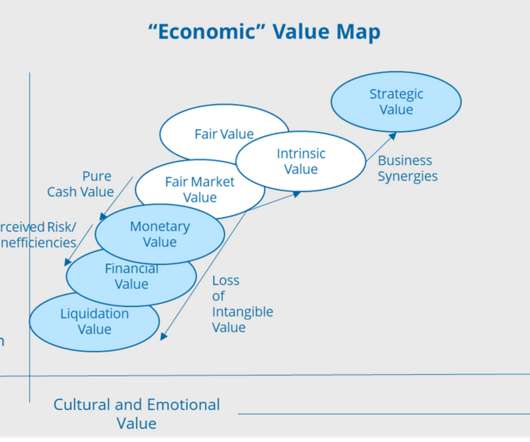

Transcending Value – Liquidation, Monetary, Financial, and Strategic Value

Value Scope

JUNE 2, 2021

Environmental, social, and governance (ESG) value is relatively new, and gaining acceptance in corporate America. Hedonic value has various meanings and uses but is usually thought of as the immediate, emotional gratification (perhaps a cause for impulse buying), as contrasted to utilitarian value.

Let's personalize your content