Fundraising Strategy: How Much and When to Raise

Equidam

MAY 2, 2022

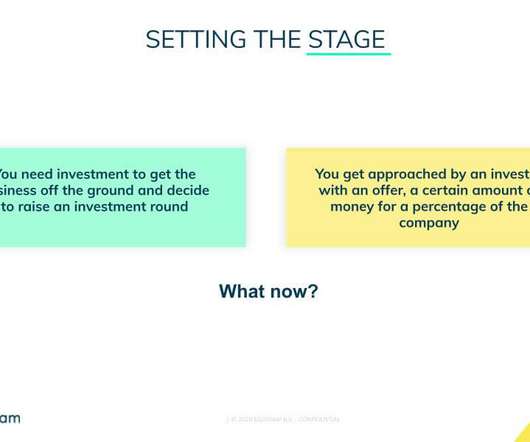

There’s no shortage of content covering startup fundraising advice, whether it’s solidifying your valuation or financial projections , or timing your fundraising sprints. Founders can follow a pretty solid roadmap once they decide to pull the trigger, but how do you know when the time is right? Milestones.

Let's personalize your content