Data Update 2 for 2022: US Stocks kept winning in 2021, but…

Musings on Markets

JANUARY 19, 2022

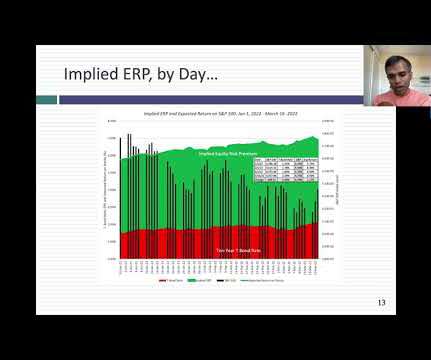

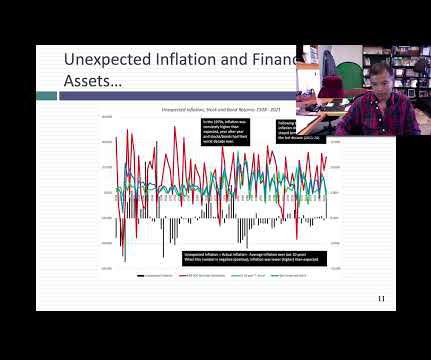

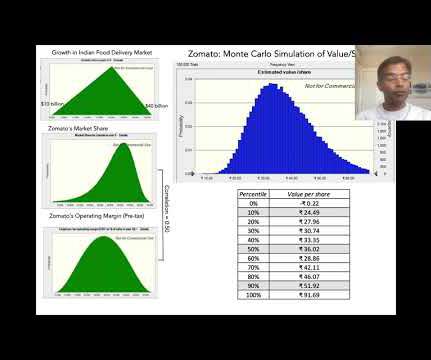

In this post, I will begin with a historical assessment of stock returns in the recent past, then move on to evaluate the returns that investors can expect to make, given how they are priced at the start of 2022, and end with a do-it-yourself valuation of the index right now. The year that was.

Let's personalize your content