Data Update 2 for 2022: US Stocks kept winning in 2021, but…

Musings on Markets

JANUARY 19, 2022

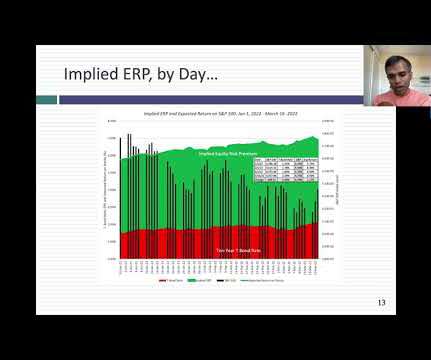

The results are similar if you break stocks down based upon price to book ratios or revenue growth rates. The Implied ERP - Start of 2022 I have computed the implied equity risk premium at the start of every month, since September 2008, and during crisis periods, I compute it every day.

Let's personalize your content