Reaping the Whirlwind: A September 2022 Inflation Update!

Musings on Markets

SEPTEMBER 27, 2022

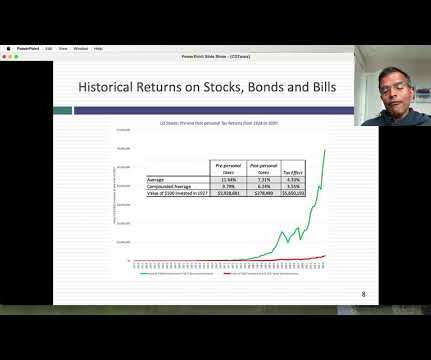

There is a market-based estimate of inflation that comes from the US treasury market, where a comparison of yields on a treasury bond with that on a inflation-protected treasury bond of equivalent maturity provides a measure of expected inflation.

Let's personalize your content