The Effect of Board Independence on Dividend Payouts

Reynolds Holding

DECEMBER 5, 2022

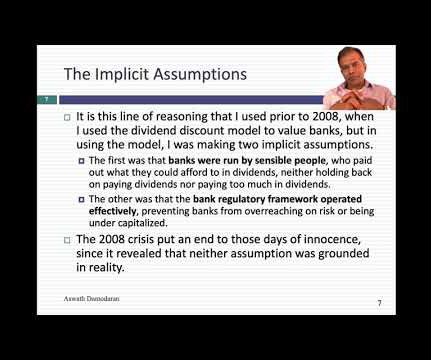

In a new paper, we use agency theory to explore the effect of board independence on dividend policy. Dividends serve as a governance mechanism to mitigate agency conflicts, reducing free cash flows, which managers may exploit for personal gain rather than using them to maximize shareholder wealth.

Let's personalize your content