The Corporate Calendar and the Timing of Share Repurchases and Equity Compensation

Harvard Corporate Governance

APRIL 28, 2022

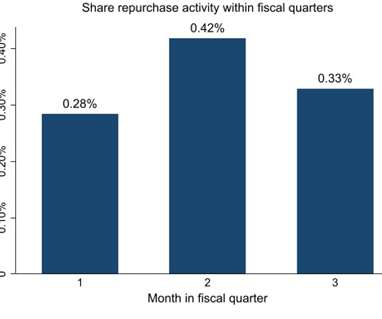

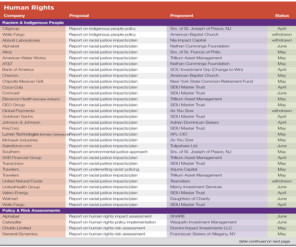

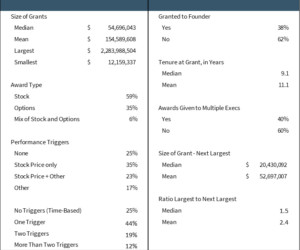

Wang (discussed on the Forum here ); and Share Repurchases, Equity Issuances, and the Optimal Design of Executive Pay by Jesse M. 2013 ) and specifically the CEO ( Moore, 2020 ) are more likely to sell equity when firms buy back stock. 2021) present evidence consistent with stock price manipulation around the vesting of CEOs’ equity.

Let's personalize your content