Paying Well By Paying for Good

Harvard Corporate Governance

JUNE 25, 2022

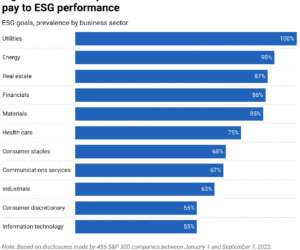

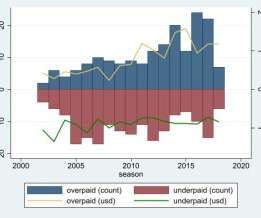

Posted by Phillippa O’Connor and Tom Gosling, PricewaterhouseCoopers UK, on Saturday, June 25, 2022 Editor's Note: Phillippa O’Connor is a Reward & Employment Leader at PwC United Kingdom, and Tom Gosling is an Executive Fellow in the Department of Finance at London Business School. ESG targets are increasingly prevalent in pay.

Let's personalize your content