M&A Valuation Methods: Your Essential Guide with 7 Key Methods

Valutico

MAY 6, 2024

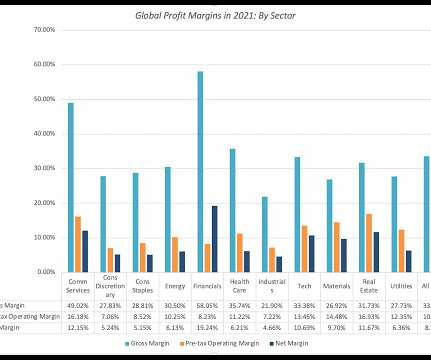

Valutico | May 7, 2024 Valuation is really important in finance. This guide talks about the main ways we figure out value during M&A deals, why they’re useful, and what challenges they bring. Different methods are used, like looking at market prices, predicting future profits, and evaluating assets.

Let's personalize your content