Embedded finance: The choices and trade-offs for US banks

Mckinsey and Company

APRIL 11, 2024

Banks can design an embedded-finance offering based on their size, distribution footprint, customer base, and product portfolio. No risk, no reward.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Mckinsey and Company

APRIL 11, 2024

Banks can design an embedded-finance offering based on their size, distribution footprint, customer base, and product portfolio. No risk, no reward.

Harvard Corporate Governance

MAY 12, 2023

Posted by Carola Frydman (Northwestern University) and Chenzi Xu (Stanford University) , on Friday, May 12, 2023 Editor's Note: Carola Frydman is Professor of Finance at the Kellogg School of Management at Northwestern University, and Chenzi Xu is an Assistant Professor of Finance at Stanford University Graduate School of Business.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Harvard Corporate Governance

APRIL 17, 2023

Yellen Professor of Finance and Management at the Yale School of Management and the Director of the Yale Program on Financial Stability; and Paul Schmelzing is an Assistant Professor of Finance at Boston College and a Research Fellow at the Hoover Institution, Stanford University. This post is based on their recent paper.

Harvard Corporate Governance

OCTOBER 3, 2022

Posted by Rainer Haselmann (Goethe University Frankfurt), Christian Leuz (University of Chicago Booth School of Business), and Sebastian Schreiber (Goethe University Frankfurt), on Monday, October 3, 2022 Editor's Note: Rainer Haselmann is Professor of Finance, Accounting, and Taxation at Goethe University Frankfurt, Christian Leuz is Charles F.

Harvard Corporate Governance

MARCH 27, 2023

Bebchuk (Harvard Law School) , on Monday, March 27, 2023 Editor's Note: Lucian Bebchuk is the James Barr Ames Professor of Law, Economics, and Finance and Director of the Program on Corporate Governance at Harvard Law School. ” SNB also pledged to provide CS with liquidity if necessary. more…)

Mckinsey and Company

APRIL 20, 2023

Green bank financing could mobilize hundreds of billions in investment toward net-zero emissions by 2050 as well as advancing environmental justice in the US.

Harvard Corporate Governance

DECEMBER 21, 2023

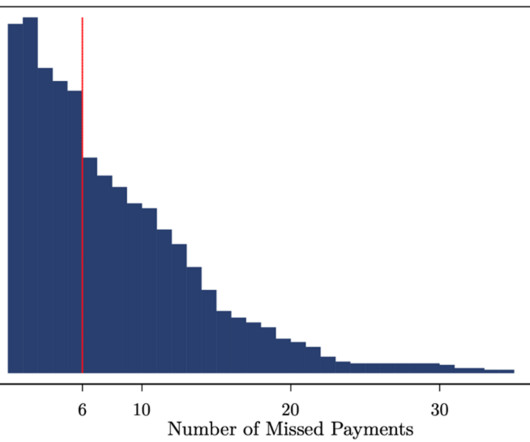

Posted by Vincenzo Pezone (Tilburg University), on Thursday, December 21, 2023 Editor's Note: Vincenzo Pezone is an Associate Professor of Finance at Tilburg University. Once capital is infused, bank managers may have an ex post incentive to avoid making dividend payments on the preferred stock purchased by the government.

Harvard Corporate Governance

JANUARY 31, 2024

Posted by Sanjai Bhagat and Henry Laurion, University of Colorado Boulder, on Wednesday, January 31, 2024 Editor's Note: Sanjai Bhagat is Professor of Finance, and Henry Laurion is Assistant Professor of Accounting at the University of Colorado Boulder Leeds School of Business. This post is based on their SSRN working paper. more…)

Fox Corporate Finance

APRIL 30, 2024

Zur Verstärkung unseres Investment Banking Teams suchen wir ab sofort Unterstützung als: Investment Banking Investment Banking Associate (m/w/d) – überdurchschnittlich attraktive Vergütung im Topquartil der Investmentbanken – Wir bieten einen einzigartigen Karriereeinstieg/-entwicklung bei FCF als.

Mckinsey and Company

NOVEMBER 24, 2022

Banks finance carbon-emitting businesses, and they finance decarbonization of the economy, as well. How effectively they address financed emissions can make all the difference.

Benzinga

MARCH 6, 2024

Bending Spoons SpA, headquartered in Milan, has been in discussions with banks regarding financing for the prospective deal, Bloomberg reported , citing people familiar with the matter. (NASDAQ: VMEO ) is reportedly being considered for acquisition by Bending Spoons SpA , a major European mobile app developer.

Brian DeChesare

NOVEMBER 22, 2023

I never expected to revisit the topic of bulge bracket banks so quickly because the full list changes slowly, and we updated it a few years ago. What is a “Bulge Bracket Bank”? The name “bulge bracket” (BB) comes from the prospectus for an IPO or debt issuance, which lists all the banks underwriting the deal.

Fox Corporate Finance

APRIL 16, 2024

On a quarterly basis, FCF publishes its FCF Bank Monitor. The FCF Bank-Monitor is a research report, based on publicly available data, on the most active and largest 22 banking institutions addressing the German and.

Harvard Corporate Governance

APRIL 4, 2022

Open Finance seeks to harness the potential of new platform technology to enhance customer data access, sharing, portability, and interoperability—thereby leveling the informational playing field and fostering greater competition between incumbent financial institutions and a new breed of fintech disruptors.

Brian DeChesare

MARCH 27, 2024

If you go by most online discussions, investment banking spring weeks in the U.K. are as essential as oxygen or high grades if you want to work at a large bank. Banks are also to blame because they now market spring weeks to students as young as 16. How to Apply for Investment Banking Spring Weeks Who Wins Spring Week Offers?

Avanade

MAY 2, 2023

Trust is key in navigating the future of banking and finance. Read this blog post for insights on the evolving relationship between tech and trust.

Brian DeChesare

FEBRUARY 15, 2023

When it comes to investment banking in Australia , it’s easy to find complaints online. These complaints center on a few aspects of the banking industry there: Recruiting – People often claim that it’s much more difficult to win interviews and job offers, that nepotism is widespread, and that there aren’t many “side doors” into finance.

Brian DeChesare

DECEMBER 20, 2023

If you want to know how to get an investment banking internship, it’s simple: Start very, very early and have a great “Plan B” if something goes wrong. And yes, you read the news correctly: Banks like RBC, DB, Houlihan Lokey, Rothschild, and Guggenheim opened 2025 summer internship applications in calendar year 2023.

Harvard Corporate Governance

FEBRUARY 8, 2024

Widely held concerns about inflation, rising interest rates, and a possible recession combined to slow debt financing and deal activity in the first half of 2023. Private equity sponsors, in particular, held back on debt-financed leveraged buyouts while watching to see whether interest rates (or business valuations) would fall.

Benzinga

APRIL 23, 2022

million in debt financing to buy Twitter, Inc. NASDAQ: TSLA ) CEO shared his vision for Twitter, which went a long way toward convincing a bevy of banks to give commitments, according to a report by Bloomberg. Elon Musk disclosed in a filing on Thursday that he has received commitments for $46.5 NYSE: TWTR ).

Harvard Corporate Governance

DECEMBER 14, 2022

Zetzsche is Professor and ADA Chair in Financial Law at the University of Luxembourg and Director of the Center for Business & Corporate Law at Heinrich Heine University in Duesseldorf; Ross Buckley is Scientia Professor and King & Wood Mallesons Chair of International Finance Law at the University of New South Wales; and Douglas W.

Avanade

AUGUST 9, 2022

In Asia, the signs of the times are unmistakable – open banking is here to stay. How can traditional banks keep up and compete with fintechs and digital banks?

Fox Corporate Finance

FEBRUARY 1, 2024

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Bank Monitor – Q4 2023”. FCF regularly engages in research on the banking sector based on available data from the most active and. Read more The post FCF Bank Monitor – Q4 2023 published appeared first on FCF Fox Corporate Finance GmbH.

Mckinsey and Company

OCTOBER 13, 2022

Winners are already emerging in the race to provide banking and payments infrastructure for embedded finance, but incumbents and new entrants still have time to claim a share of this dynamic market.

Brian DeChesare

FEBRUARY 16, 2022

One of the more controversial industry groups is public finance investment banking. The controversy starts with the name: Is public finance “really” investment banking? You could argue this either way, but the short answer is yes , public finance still counts as investment banking.

Law 360 M&A

APRIL 11, 2024

French banking giant Societe Generale SA said Thursday that it has agreed to sell its professional equipment financing business to rival BPCE for €1.1 billion ($1.2 billion) to streamline the business and bolster its equity capital.

Global Finance

JULY 20, 2023

Global Finance Magazine - South Korea will allow new domestic players into its banking industry to break the domination of the sector by just five commercial banks.

Harvard Corporate Governance

JANUARY 24, 2023

Obtaining committed financing, in particular, will require both creativity and avoiding the urge to let the perfect become the enemy of the good. more…)

Mckinsey and Company

JULY 12, 2022

At McKinsey’s Tomorrow Conference, three European executives discussed the capital requirements and banks’ efforts to help companies meet them. Getting to net-zero emissions can be complex and costly.

Reynolds Holding

MAY 13, 2024

We argue that bank regulation and supervision interfere with pricing risk by creating opacity. This would make capital markets more effective in addressing future banking problems and reducing reliance on bank regulators who have arguably failed the public. Given periodic banking crises in the U.S.,

Brian DeChesare

JANUARY 18, 2023

If you want to stimulate the urge to poke out your eyes and jump into a pool of lava, try searching for “Is Finance a Good Career Path?” Most articles present generic details everyone already knows, such as “finance jobs pay higher salaries, on average.”. Definitions: What is “Finance,” and What is a “Good Career”?

Fox Corporate Finance

OCTOBER 16, 2023

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Bank Monitor – Q3 2023”. FCF regularly engages in research on the banking sector based on available data from the most active and. Read more The post FCF Bank Monitor – Q3 2023 published appeared first on FCF Fox Corporate Finance GmbH.

Lighter Capital

JULY 22, 2023

Banks are notoriously , averse to lending to SaaS startups. Convertible debt is relatively low-interest and converts into equity at a specified date (generally after a round of equity financing). Revenue-based financing If you’re generating $200K in ARR or more, Lighter Capital’s , revenue-based financing can be a good option for you.

Harvard Corporate Governance

JANUARY 17, 2024

Schiff Professor of Investment Banking at Harvard Business School; Jinlin Li is a Postdoctoral Research Fellow at Harvard Kennedy School and Harvard Business School; and Tong Liu is the Judy C. The academic literature on entrepreneurial finance has largely treated investors and entrepreneurs as distinct identities.

Reynolds Holding

OCTOBER 19, 2023

Thus far, however, little has been written about the gamification of banking – the topic of our recent article. [3] think that playing games about money, such as Monopoly, helps them learn the basics of finance. [5] bank [7] – acquired fintech gamification app, Long Game Savings, Inc. [8] Bank in 2022, “embedd[ing] U.S.

Reynolds Holding

NOVEMBER 28, 2022

In advancing this view, Congress and the regulators appear to be following a path laid out by crypto companies seeking legitimacy through inclusion (on their own terms), in regulated finance. In fact, despite the “dress-up” clothes it wears, crypto trading isn’t finance or financial services at all. Crypto and the Purpose of Finance.

Fox Corporate Finance

JULY 24, 2023

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Bank Monitor – Q2 2023”. FCF regularly engages in research on the banking sector based on available data from the most active and. Read more The post FCF Bank Monitor – Q2 2023 published appeared first on FCF Fox Corporate Finance GmbH.

Mckinsey and Company

DECEMBER 18, 2023

Macroeconomic, technological, regulatory, market structure, and product changes mean corporate and investment banks must take new approaches to tackling the opportunities and challenges ahead.

Benzinga

MARCH 16, 2023

The Capital Playbook Podcast Show is thrilled to announce the premiere of its latest episode, "Regions Bank Acquisition of Sabal Capital Opens Up Hotel and Multifamily Financing Nationwide," on Thursday, March 16, 2023, at 11:00 AM CST.

Reynolds Holding

MAY 5, 2024

Central bank digital currencies (CBDCs) are coming. Around the world, central banks are building CBDCs for testing in trials and pilots, both domestic and cross-border. banks and corporations, among other factors, its policymakers need to think long term. They range from less interest on U.S. However, this has not been the case.

Benzinga

OCTOBER 5, 2022

NASDAQ: TSLA ) and Twitter, it could pose a headache for the banks that have given financing commitment , reported Bloomberg. Wall Street banks, led by Morgan Stanley (NYSE: MS ), had, in April, given a commitment for $12.5 debt financing with the intention of selling most of it. Full story available on Benzinga.com.

Benzinga

MARCH 14, 2024

NYSE: SF ) today announced it has signed a definitive agreement to acquire Finance 500, Inc. Finance 500") and CB Resource, Inc. ("CBR"). We all share the same client-driven approach and expect the Finance 500 and CBR teams to seamlessly integrate into our platform." Terms of the transaction were not disclosed.

Fox Corporate Finance

APRIL 12, 2023

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Bank Monitor – Q1 2023”. FCF regularly engages in research on the banking sector based on available data from the most active and. Read more The post FCF Bank Monitor – Q1 2023 published appeared first on FCF Fox Corporate Finance GmbH.

Global Finance

AUGUST 13, 2023

Citi Private Bank has advised sports deals of all kinds for some 25 years. talks to Global Finance about why the sector is attracting so much interest. Ivo Voynov, who joined the firm in September from rival JPMorgan Chase & Co.,

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content