Deregulation and Board Policies: Evidence from Performance Measures Used in Bank CEO Turnover Decisions

Harvard Corporate Governance

SEPTEMBER 14, 2022

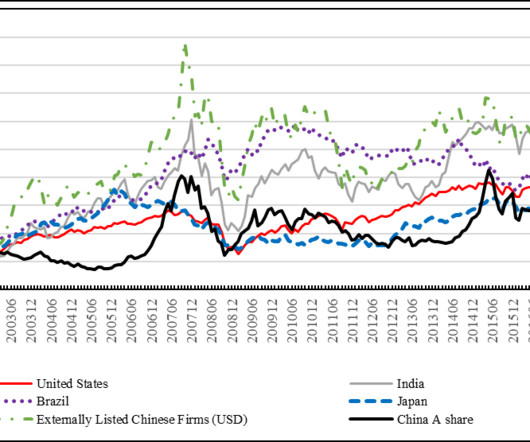

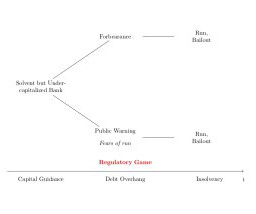

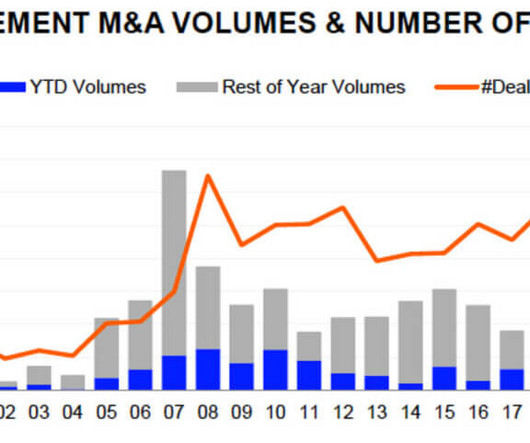

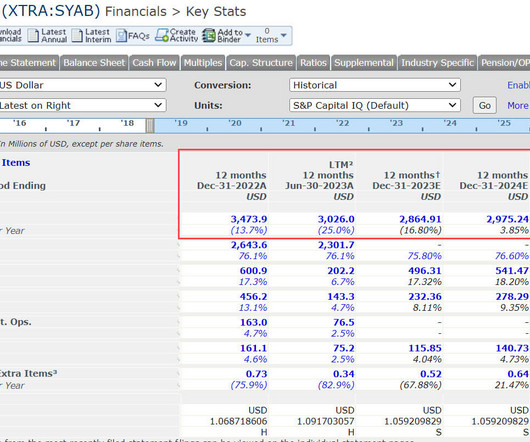

The banking industry has undergone substantial changes since the late 1970s, largely due to deregulation and rapid market developments. Over that period, banks’ growth opportunities expanded, and banks entered new markets, both geographic and product. Cunat and Guadalupe 2009; DeYoung et al.

Let's personalize your content